Operational update

In our view, 2022 was a breakthrough year for XTPL. Sales of its proprietary nanoprinting system for prototyping, the Delta Printing System (est. sales price of EUR 150-200k each), each of which generates recurring revenues from e.g. nozzles and inks of c. EUR 1,000 per month, and the conductive nano-ink (our estimate: EUR 1-10k each) significantly picked up. We believe that since 2020, when the company started commercial sales, it has sold 10 Delta Printing Systems to international clients such as universities (e.g. University of Stuttgart, University of Brescia, Tianjin University), R&D centers (e.g. Harbin Institute of Technology) and corporate clients (one of the five largest Tech companies from the US).

However, in our view more important for future growth are the contracts that can lead to the application of XTPL’s technology on production lines. One of them is the contract with NASDAQ-listed Israeli Tech company Nano Dimension, with which XTPL announced a contract for the development of a new kind of nano-ink in January 2022 that is supposed to be used in the production of Nano Dimension’s advanced PCB boards in the future. In our view, XTPL receives c. USD 500k after each stage of the development phase – 3 out of 4 have already been completed – and will receive a percentage fee based on the volume sold of products that will be produced with its technology in the future. Other two partners for the application of XTPL’s technology on an industrial scale, for which XTPL is supposed to construct machine prototypes, are from Taiwan (application area: production of semiconductor elements at a leading global player from this industry) and listed HB Technology from South Korea (application area: production of displays e.g. for Samsung). The implementation of XTPL’s technology on production lines will result in one-off sales of the company’s printing modules (several dozen ones worth est. EUR 50-100k each) as well as significant recurring sales of consumables such as nozzles and inks.

According to its management, XTPL currently has 45 employees, of which 90% are shareholders of the company. The fluctuation is very low (only one person left the company in 2022).

So far, XTPL has received 4 international patents and has submitted 26 patent applications. We believe that only the company’s patents have a value of dozens of millions EUR.

Latest financials

In 9M/22, XTPL generated revenues of PLN 6.6m (9M/21: PLN 213k), of which PLN 4.6m from R&D and PLN 2.1m from sale of own products. PLN 1.9m stemmed from EU grants. EBIT equalled PLN -2.1m (9M/21: PLN -6.4m) and net income PLN -2.2m (PLN -6.6m), with total operating costs (CoGS, administration & distribution expenses) of PLN 10.6m or PLN 1.18m per month. Q3/22 was the first quarter in the company’s history, which was profitable on all levels.

At the end of September 2022, XTPL’s cash position amounted to PLN 3.2m (31/12/2021: PLN 4.5m). In 9M/22, operating cash flow equalled PLN 1m (9M/21: PLN -3m) and free cash flow PLN -621k (PLN -5.6m). The convertible bond on the balance sheet (PLN 3.38m) – was issued to XTPL’s German shareholders Deutsche Balaton AG and ACATIS – has a yearly interest rate of 5%, matures on 30 January 2024 and has a conversion price of PLN 74 per share (33.9% below current level; conversion to in total 45,655 new shares that correspond to 2.2% of the total number of shares outstanding). During our recent meeting XTPL’s management maintained its view that at the end of 2022 cash was at the same level as at the end of December 2021.

Summary & forecasts for 2023

After talking to the company’s clients and market experts in the last months, we are confident that XTPL’s technology offers tremendous advantages and there is strong market demand for it. Apparently, large global players from the semiconductor or display industries are already approaching the company themselves. Also, we now believe that the company’s team knows how to effectively commercialize its know-how.

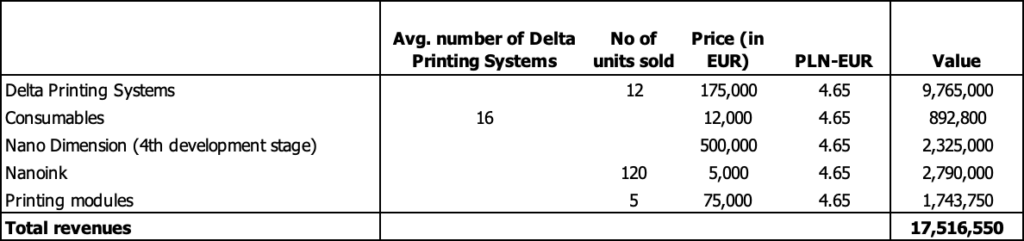

We expect significant growth of XTPL in the coming years, especially due to the implementation of its technology on production lines of several international Tech companies. For 2023E, we estimate the company’s backlog at PLN >10m and revenues at PLN 17.5m. Despite a likely increase of operating costs e.g. due to the planned recruitment of c. 10 additional people and higher investments in marketing, management guide for a profit on all levels.

Below is our detailed calculation of revenues in 2023. During our meeting management clearly emphasized that in the coming years its focus would be on top-line growth.