Business description

Since 1995, when its predecessor Excalibur Army was founded by Mr. Jaroslav Strnad—the father of its current CEO and owner—the Czechoslovak Group (CSG) has grown organically and through acquisitions into a global operation with more than 100 subsidiaries and over 14,000 employees. Today, the Group, which is based in Prague, is a rapidly growing European defence and industrial conglomerate with operations spanning three segments: Defence Systems, Ammo+, and Others.

In the Defence Systems segment, the company develops, produces, and sells military and special wheeled and tracked vehicles (e.g., Pandur 8×8 EVO infantry vehicle), temporary bridge systems (especially AM 70 EX and AM 50 EX), special weapon systems, medium/large-calibre ammunition (where the company is No. 1 in Europe, e.g., through its Spanish subsidiary FMG Granada) for combat vehicles, artillery, tanks, and small arms, as well as equipment for pyrotechnic services. In addition, the companies in this division produce e.g. radars, complex air traffic control systems, situation awareness tools for general aviation, and anti-drone systems.

The Ammo+ segment basically comprises the operations of the US-based Kinetic Group—which, with brands such as Remington, CCI, Speer, and Hevi-Shot, is a leading producer of small-calibre ammunition with revenues exceeding USD 1.5bn (CSG acquired it in 2024 for USD 2.2bn)—and the 100%-owned Italian company Fiocchi, the No. 3 worldwide in small-calibre ammunition production, with facilities in Italy, the UK, and the US. In this segment, CSG is the No 1 worldwide.

The Others segment mainly comprises:

1. TATRA TRUCKS, the third oldest car manufacturer in the world with more than 170 years of tradition in the production of vehicles, which focuses on heavy vehicles for extreme terrain and the worst climatic conditions with a unique chassis concept.

2. DAKO-CZ, one of the three largest European manufacturers of brake systems and components for the world’s leading manufacturers and operators of rail vehicles.

3. Armi Perazzi, an Italian company with a history of >60 years that specialises in the production of high-quality hunting and sporting shotguns.

In 2024, CSG’s Defence Systems segment dominated with a share of 66.4% (EUR 3.4bn) in total revenues (incl. Kinetic Group total Group revenues equalled EUR 5.1bn, without EUR 4bn) and a 73.5% share in total EBITDA (EUR 987m). The Ammo+ segment accounted for EUR 1.66bn of revenues and EUR 343m of EBITDA and Others for EUR 77m and EUR 19m respectively.

In terms of geographical markets, Europe accounted for 68% of revenues (thereof: Ukraine 33.1%), USA 25.8%, and the rest of the world 6.2%. 61% came from NATO countries. With c. 40 production facilities in Czechia, Slovakia, US, Germany, UK, Italy, Serbia, Spain, and India, the Group distributes its products to key long-term customers, ranging from government bodies (mainly NATO members) to leading companies in >70 countries worldwide.

IPO

On January 23, 2026, CSG was listed on the Euronext Amsterdam at a share price of EUR 25, which implied a market capitalisation of EUR 25bn. During the IPO its CEO Michal Strnad sold 102.17m shares (plus potentially 19.83m as part of the over-allotment) worth in total max. EUR 3bn. In addition, the company issued 30m new shares worth EUR 724m net, which will be used for expansion incl. several acquisitions. Cornerstone investors such as Artisan Partners, BlackRock and Quatar’s Al-Rayyan Holding committed EUR 900m (EUR 300m each, in total 36m shares with no lock-up).

After the IPO, Mr Strnad will own via his vehicle CSG FIN a.s. 86.77% of the shares without the full over-allotment and 84.78% if the over-allotment option will be fully exercised. His shares will be subject to a 360-day lock-up period.

Financials

Between 2022 and 2024, CSG (without accounting for Kinetic Group) grew its revenues from EUR 1bn to EUR 4bn, implying a CAGR of 98.7%. Over the same period, the EBITDA margin increased from 18.8% to 26.9% and net income from EUR 141.1m to EUR 633.4m. With a total backlog of EUR 14bn (2.8 x LTM Q3/25 revenues) and a pipeline under negotiation of EUR 32bn (6.6x) – thereof EUR 17bn mid/large calibre ammo, EUR 9bn land systems, EUR 4bn defence electronic, EUR 2bn small calibre ammo – revenues reached EUR 4.5bn in 9M/25 (+82.4%, +29.8% y-o-y if Kinetic Group’s contribution is accounted for in 9M/24, 76% share of Defense Systems, 22% Ammo+, 2% Others), the EBITDA margin 26.4% and net profit from continuing operations EUR 511.5m (+22.5%). Net debt equalled EUR 3.59bn, however it will be reduced by the IPO proceeds.

In terms of guidance, for 2025E management forecasts revenues of EUR >6.4bn and an adjusted operating EBIT margin of 24-25% (in 9M/25, it equalled 24.5%). For 2026E, revenues are expected to be in the range of EUR 7.4-7.6bn at an unchanged adjusted operating EBIT margin y-o-y. The main reason for the growth in 2026E is supposed to be the Group’s Land Systems and M&L Ammo units of CSG Defence Systems segment as well as a recovery in Ammo+. Over the medium term, CSG targets mid-teens organic revenue CAGR.

Summary & Conclusion

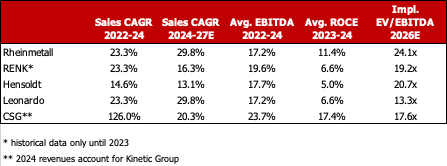

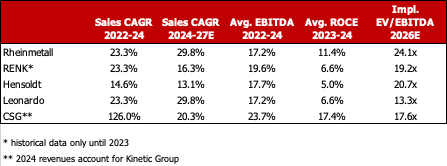

An estimated EBITDA of EUR 2bn in 2026E would translate into a 2026E EV/EBITDA multiple of 17.6x at present. This is significantly below the 24.1x of German Rheinmetall, the 19.2x of RENK, and the 20.7x of Hensoldt, but higher than the 13.3x of Italian Leonardo, whose EBITDA margins and ROCE are however significantly below those of CSG. Thus, we believe that CSG’s current valuation remains attractive. In addition, management targets a payout ratio of 30–40% of annual net profit starting in 2027E, based on 2026E results.

The defence industry—especially in Europe—remains highly attractive given the threat from Russia and NATO’s target for defence spending, which is expected to increase from 2.76% on average in 2025 to 5% by 2035E. According to various sources, the global military sector is expected to grow from approx. USD 2.8tr in 2025 to USD 4.7–6.6tr by 2035E, with Europe and Asia-Pacific as the fastest-growing regions.

The main risks are that a large portion of CSG’s revenues depends on obtaining and maintaining export licenses and that a peace treaty in Ukraine would likely negatively affect defence stock valuations.