With a share of 26.6% of industrial production in total GDP, Germany is the most industrialized EU country. The German chemical, machine-building and automotive sectors are world leading and many family-owned companies are dependent on them. Especially, the chemical sector is regarded as the most energy-intensive one, together with the metal processing industry. According to Statista, in 2022 309,030 of Germans worked in the chemical, 1m in the machine-building, c. 786,000 in the automotive and c. 500,000 in the metal processing industry. The respective companies usually pay above-average salaries. In terms of energy sources, Germany has diversified away from (cheap) Russian oil & gas deliveries since February 2022 and nowadays Norway is its most important supplier of gas and oil. Last year, energy from gas still accounted for 11.4% of the country’s total energy consumption. When it comes to trade, the German economy heavily depends on China, which in 2022 was its No 1 partner and generated a trading volume (imports + exports) of EUR 298.2bn.

Given the above, the German economy faces two main risks: 1. High energy prices in the long run, especially as Germany is the only country worldwide, which plans to completely withdraw from fossil energy and nuclear power so fast, and 2. A China-Taiwan war. The first scenario would likely result in the movement of production capacity – and loss of high-paying jobs – from Germany to other parts of the world. Especially, North America seems to be an attractive destination as it has access to cheap energy and is a net exporter of it. The second would significantly negatively affect the German economy as a conflict in Taiwan would likely result in sanctions by the US and the EU like those imposed on Russia after its invasion in Ukraine in February 2022.

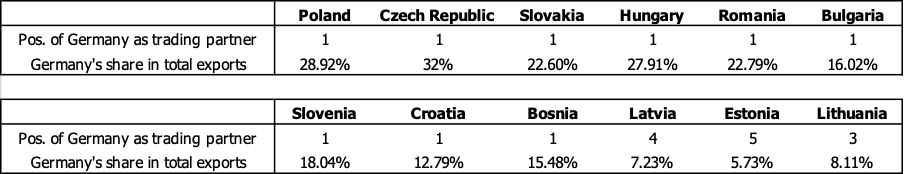

While we believe that especially the 2nd scenario seems unlikely for now as China needs the Western world as a trading partner – USA and Germany were its No 1 and 7 trade partners respectively in 2022 and the EU as a whole No 2 after ASEAN – and supplier of advanced technology, the above-mentioned factors also bear significant risks for Eastern European countries. For most of them, Germany is the largest trading partner by far (see table below) and a significant share of employees has jobs in German companies or their suppliers. For example, automobile producers such as VW Group (9 in Poland, 4 in the Czech Republic, 2 in Slovakia, 1 in Bosnia, 1 in Hungary), Mercedes-Benz (1 in Poland, 1 in Romania, 1 in Hungary) and BMW (1 in Hungary) have many production facilities in the CEE/SEE region. The same holds for chemical companies – which are particularly energy-intensive – such as BASF (19 production facilities in CEE) and Lanxess (3).

Source: World Bank, stat.ee (most recent data)