Recently, we had a call with XTPL’s management. We have once again confirmed our conviction that the company has chosen the right commercialisation strategy and the business is moving in the right direction.

In the US and Asia, XTPL has been able to hire experienced sales managers from its main competitor Optomec, which confirms the results of our research that the company’s technology is considered superior to all comparable international providers. In addition to its local sales teams, XTPL works with currently 12 distributors. So far, the company has sold its products to clients from 21 countries worldwide.

In terms of staff size, in 2023 XTPL increased its team by 25 people to 70. Since January 2024, it has hired 20 more employees, which are necessary for reducing production times and growing sales, but we believe will negatively affect profitability this year. Further, larger hirings are only planned in 2026E. Currently, XTPL employs 11 own sales & marketing staff.

Regarding the sales pipeline and products, the most important area of activity is of course industrial implementation, which will allow XTPL to significantly ramp up its revenues and generate a high share of recurring revenues. According to the CEO, there are currently 20+ industrial projects in the company’s pipeline, of which 9 are at least in the 2nd evaluation phase (out of 5 in total), and 4 in the 4th stage. We believe that at one of XTPL’s industrial partners a machine that uses the company’s technology is already ready and undergoing final tests, which makes a first industrial implementation in 2024E likely.

When it comes to other products, apparently 80 Delta Printing Systems are currently in the sales pipeline and due to investments in 2023 the company has reduced their production time by half. Moreover, XTPL has extended its offer by gold nanoinks and plans to introduce copper-based ones soon.

With a cash level of c. PLN 20m, we estimate XTPL’s current monthly cash burn at PLN 2-2.5m. In our view, additional funding – if at all necessary in the future – will be debt.

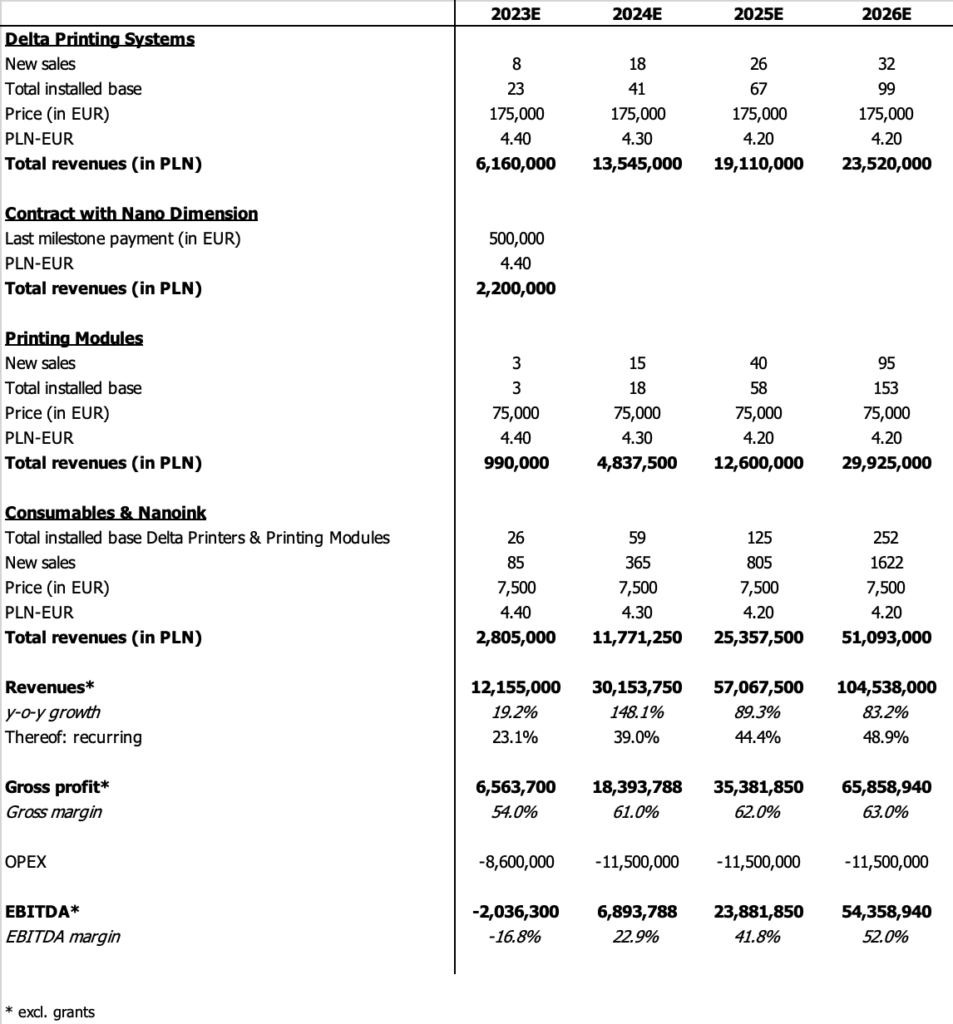

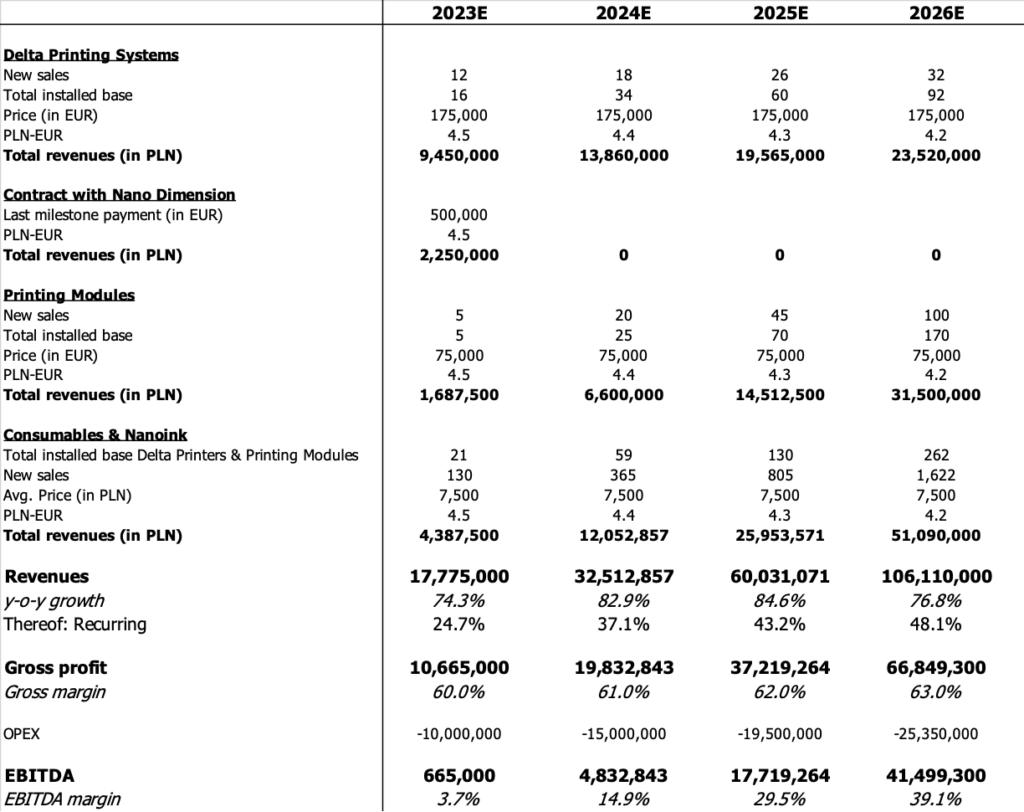

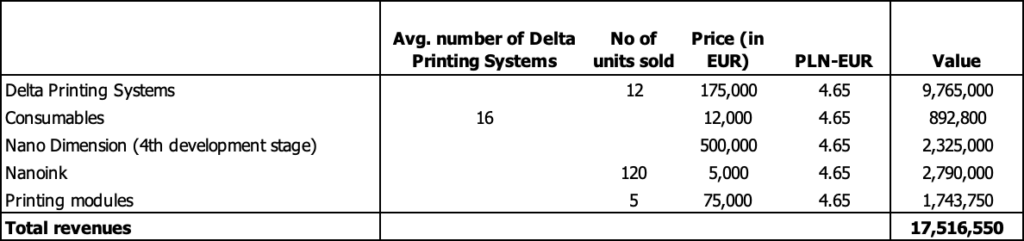

Below are our updated estimates for XTPL in 2024E-2026E. While our assumptions for 2025E-2026E remain unchanged, we now believe that growth this year will be weaker and the company will still not be at EBITDA break-even . We expect higher sales of Delta Printing Systems y-o-y, the majority of which will be generated in H2/24E. By 2026E, XTPL is supposed to sell up to 100 (2023: 3) industrial modules – the production of which is very scalable and will also be conducted by contract manufacturers, according to management – and max. 40 Delta Printing Systems. 50% of sales then should stem from industrial implementations.