Current trading

On January 3rd, XTPL announced its long-awaited first industrial implementation with a multi-billion USD Chinese partner from the display sector. While the initial order for six printing modules (UPDS) is relatively small, the potential of the deal is significant (several dozen printing modules in 2025E alone, along with corresponding service revenues and substantial volumes of nanoink). More importantly, the first industrial implementation is likely to accelerate the three others that are very close to being signed. These include deals from the US and Taiwan, related to PCBs and semiconductors, which could generate higher revenues going forward than the Korean one, which is focused on the display industry.

In total, XTPL is in talks with 20 international partners regarding industrial implementation, with eight of these at an advanced stage of negotiations. Based on information from management, we estimate the total revenue potential of the 20 potential industrial projects at approximately PLN 890m per year, which is nearly three times XTPL’s current market capitalization. In terms of production capacity, XTPL plans to rely on third-party contract manufacturers.

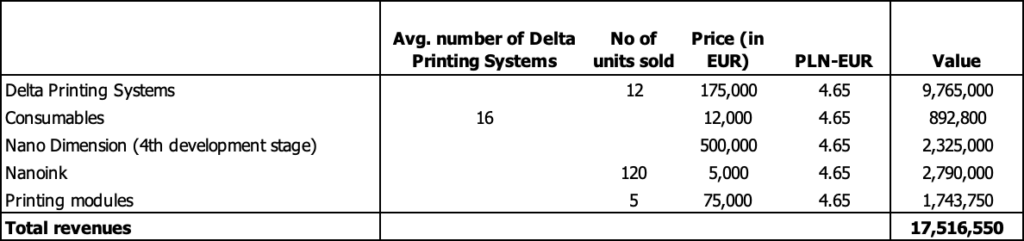

In 9M/24, XTPL’s revenues (excluding grants) reached PLN 6.7m, which represents a 27.4% decline compared to last year. This decrease was mainly due to lower sales of Delta Printing Systems (-6.6% to PLN 5.7m). Additionally, in contrast to 9M/24 last year the company generated revenues from an R&D project with NASDAQ-listed Nano Dimension related to the development of a nanoink, which is why the segment “R&D services” only reported sales of PLN 421k (-84.4% y-o-y). The segment nanoinks increased its revenues by 40.4% y-o-y to PLN 584k.

The number of staff almost doubled year-on-year to approximately 90 (including 2 highly qualified and experienced employees in the US and 1 in Asia) and distribution, administration, and other expenses increased by 58.6% year-on-year to PLN 11.8m. Thus, these costs will likely significantly exceed our previous estimate of PLN 11.5m by the end of December 2024. Gross profit amounted to PLN -6m, compared to PLN 5m in 9M/23, primarily due to a 128.6% increase in R&D expenses year-on-year.

Nevertheless, we believe the heavy investments in staff, a sales and distribution center in Boston, and production capacity related to Delta Printing Systems (DPS)—which now allows XTPL to produce three times more DPS per year and deliver them in a few weeks instead of several months—should pay off in the long run. Furthermore, the company has developed an advanced version of the Delta Printing System, called DPS+, which enables more automated production of over 100,000 units per year with high flexibility and is supposed to be targeted at Tech corporations and producers of electronics.

In general, Delta Printing Systems are used by research and corporate clients for R&D on new application areas, which opens up more possibilities for XTPL regarding industrial implementations. By 2026E, management plans to open two more demonstration centers e.g. in South Korea and Taiwan.

At the beginning of December, XTPL completed an equity issue worth PLN 31m (300,000 shares at PLN 92 per share), which we believe was primarily subscribed by long-term institutional investors from Poland and Germany (as of 30/09/2024, the company’s cash reserves amounted to PLN 4.8m after PLN 27.3m at the end of 2023). With the first signed contract for industrial implementation, the company can now apply for debt financing from banks. Therefore, XTPL’s financing until cash break-even—expected in 2026E at the latest—is now secured.

Our revised forecasts

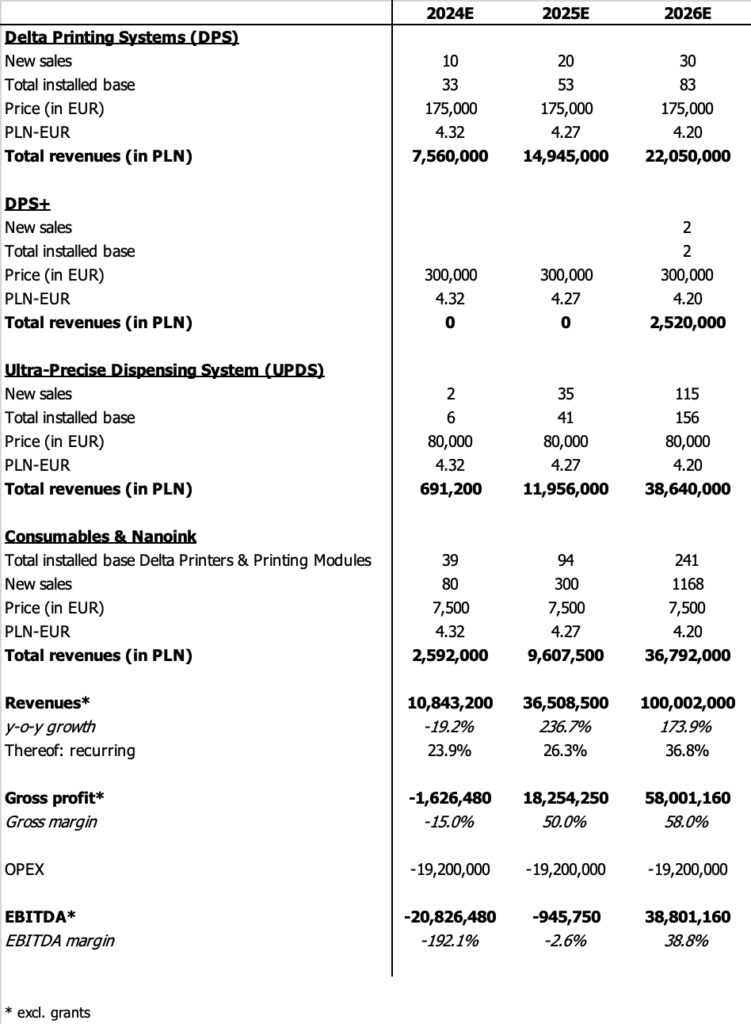

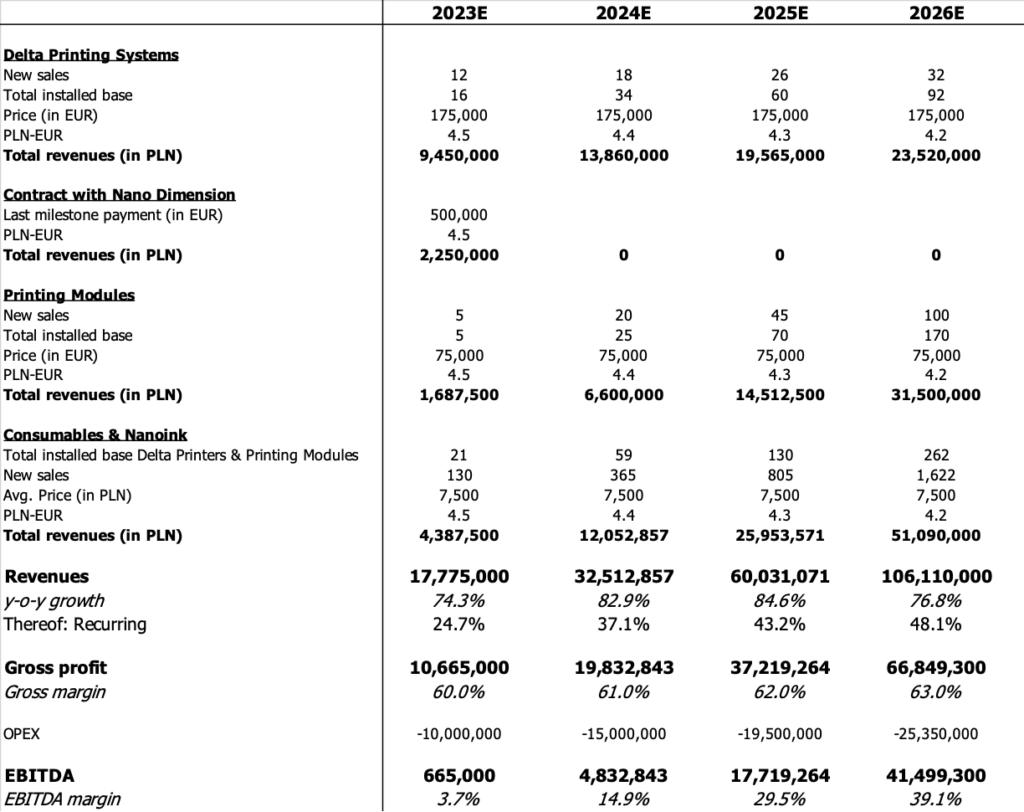

After 9M/24, we have lowered our assumption for the number of Delta Printing Systems in 2024 from 12 to 10. For 2025E, we are more conservative than management (20 devices sold vs. guidance of 30). In our new forecasts, we have also accounted for the new DPS+, of which XTPL should sell 2 devices in 2026E.

Although one industrial implementation will likely lead to orders of 10-several hundred printing heads, which we assume cost EUR 80,000 each on average, and discussions with new potential partners are much faster than with previous ones, from today’s perspective we believe that XTPL will only reach the EBITDA break-even in 2026E. We now expect a negative gross margin of -15% in 2024E (previously: 56%) and higher OPEX than before (PLN 19.2m/year compared to PLN 12m before). Below are the updated estimates for 2024E-2026E. While XTPL’s stock remains highly promising in the long run, investors must be patient and prepared for significant volatility in the share price. In our view, the first industrial implementation has demonstrated that the global Tech industry places a high value on XTPL’s technology and that the Polish company provides substantial added value to its commercial clients. As more industrial implementations are expected to be signed in 2025-26E – with management anticipating at least one additional implementation this year – we believe XTPL will ultimately be acquired by a major global player in the Tech, display, or semiconductor sectors. It is also worth emphasizing that, with 40 international patents already granted and at least 40 more pending, the company’s IP portfolio holds significant value.