Business description

Founded in 2000 by the Canadian James van Bergh, who directly and indirectly is still its largest shareholder, Benefit Systems (www.benefitsystems.pl) is today the No 1 provider of non-payroll work benefits incl. discounts for fitness, culture, restaurants, health in CEE. At the end of March 2024, the company worked with >41,000 employers (2011: 2,850) in all its regional markets. The number of its primary product, the MultiSport card, equalled 1,996,600 (2011: 235,000), thereof 1,508,800 in Poland, 231,800 in the Czech Republic (BFT has been active there since 2010), 62,000 in Slovakia, 142,200 in Bulgaria (both since 2015), 44,600 in Croatia (since 2018) and 7,200 in Turkey (since 2021). In addition to its bonus card business, for the last few years Benefit Systems has also built a chain of own fitness centers (Q1/24: in total 255 centers, thereof 224 in Poland under 14 different brands e.g. Zdrofit, Good Luck and Fit Fabric as well as 31 abroad). According to management, it currently operates the largest such chain in Poland.

Benefit Systems’ business model is comparable to an insurance in the sense that its corporate clients (sometimes also their employees to 50%) pay the company a monthly flat fee for each bonus card and the company will only have costs if the employee uses the card. Employees gain access to >9,300 facilities within a single product and can use a wide range of services, including various online add-ons/courses, for a relatively small amount of money. When users want to try out a new place to work out, they do not have to worry about filling out paperwork on site – all they need to do is show their BFT bonus card with proof of identity or the BFT app.

When it comes to employers, the bonus card makes them more attractive on the labour market, promotes employee retention and improves employee’ fitness and health, which can translate into lower costs. Moreover, Benefit Systems’ corporate clients receive one invoice rather than dozens from different facilities, which reduces their administrative work significantly.

Financials

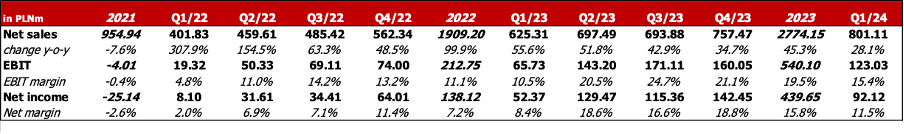

Since 2011, when it was listed on the Warsaw Stock Exchange at a price of PLN 107/share, Benefit Systems has increased its revenues and net income at a CAGR of 22.4% and 22.9% respectively. For 2023, the company paid a dividend of PLN 41/share (DYield = 1.3% at present), but between 2016 and 2022 it re-invested all its profits. In 2023, it generated a ROCE of 22.3% compared to 10.6% in 2022.

For the Jan-Mar 2024 period, Benefit Systems reported revenues of PLN 801.1m (+28.1%). While the number of bonus cards went up by 12.7% y-o-y, ARPU in all markets increased by low double-digit percentage points. The Polish business contributed 72.6% to total revenues and generated an EBIT margin of 17.7% (Q1/23: 11.6%). The international business (thereof Czech Republic: +14.1% y-o-y to PLN 124.3m, Bulgaria: +11.6% to PLN 53.2m) reported an EBIT margin of 11.6% (8.6%). With PLN -3.6m, Turkey was the only geographical market that reported an operating loss in Q1/24.

At 29.7% (Q1/23: 23.3%), BFT’s Q1/24 gross margin was strong. In Q1/24, the company’s EBIT increased to PLN 123m (+87.2% y-o-y, 15.4% margin vs. 10.5% in Q1/23, EBIT ex ESOP: PLN 130.6m) and net income to PLN 92.1m (+75.9%, 11.5% margin). Consequently, operating and free cash flow improved from PLN 177.1m in Q1/23 to PLN 244.8 and from PLN 137.5m to PLN 194.8m respectively. As of 31/03/2024, Benefit Systems’ net cash (excl. IFRS 16 leasing) amounted to PLN 505.6m compared to PLN 373.5m at the end of 2023 and PLN 7.8m as of 31 March 2022.

Conclusion

We like Benefit Systems’ attractive and highly profitable business model, which given the strong competition for employees and the popularity of non-monetary employee’ benefits in CEE/SEE has excellent growth prospects. Given its long track record and clever strategy (-> combination of bonus cards and own fitness clubs), we believe that other players such as Medicover will not threaten the company’s market leadership in the foreseeable future. In our view, there is especially strong growth potential in Turkey, a country with 85m inhabitants, 9 cities with 1m+ inhabitants and a highly dispersed fitness market.

We believe that Benefit Systems is a great stock to hold for the long term. While in 2024E management guides for max. 230k new cards (150k in Poland, max. 80k on foreign markets), a high single-digit ARPU growth and a similar unadjusted EBIT margin y-o-y (without the costs of the employee incentive scheme that management estimates at PLN 68m), we see the possibility for an increase of the guidance especially in Q4/24E, which is typically the best period of the year for the company (>30% of its annual net profit).

Benefit Systems also has an attractive dividend policy. For the years 2023-2025, it foresees the payout of at least 60% of the consolidated net profit.

Regarding risks, we believe the main ones are: 1. The outbreak of another pandemic, 2. Overinvestment in new fitness centers (in 2024E, BFT plans to open 15 new centers in Poland and min. 20 abroad).