Business description

CCC S.A. was formally established in 1999 and has been listed on the Warsaw Stock Exchange since 2004. With over 15,000 employees and operations in 23 countries, 90 e-commerce platforms, and 979 physical stores, the company is the leading footwear retailer in Central and Eastern Europe. Since its debut on the WSE, CCC has increased its revenues by 3296% (CAGR of 20.4%), reflecting the enormous growth that Poland has experienced in the last 20-30 years. CCC stores, with its own shoe brands and top global brands, can be found in almost every shopping center in Poland. Over the years, CCC has acquired many local brands that have become leading sellers in Poland, including Gino Rossi and Lasocki.

CCC’s largest shareholder is its founder, Mr. Dariusz Milek, one of Poland’s richest people, with a 33.33% stake. Many Polish funds have invested in CCC in the past, the largest being OFE Allianz Polska (a pension fund) with a 7.65% stake. Mr. Mi?ek returned to the position of CEO in 2023, having previously been Chairman of the Supervisory Board. The company’s shares can be traded on stock exchanges in Poland (Warsaw), the UK (London), and Germany (Munich, Stuttgart, Frankfurt, Berlin, Düsseldorf).

CCC Group’s business is divided into 5 main divisions: CCC (offline footwear retailer), eobuwie.pl (e-commerce footwear), Modivo (online fashion platform), HalfPrice (off-price stationary fashion stores), and DeeZee (fashion brand). Originally known as a footwear retailer, CCC Group aims to become the number one omnichannel fashion platform in the CEE region, and there are already signs of this, as recently it generated only 68.9% (-2.5% y-o-y) of total sales from footwear, while clothing already accounted for 16.5% (+3.7%).

In the last fiscal year ending February 2024, both footwear business units reported declines, while the offline/online fashion units HalfPrice and Modivo reported sales increases of 68.2% and 21.9%, respectively. In terms of profitability, the mainly offline CCC business segment reported the highest EBITDA margin of 17.3% (2022/23: 8.1%), while Modivo reported the lowest at -2.4% (+1.9%). Last year, the share of e-commerce fell to 46% (-2% y-o-y).

CCC’s management expects the rapid growth of its off-price stores under the HalfPrice brand to continue and that they will be the company’s main growth driver in the coming years.

Financials

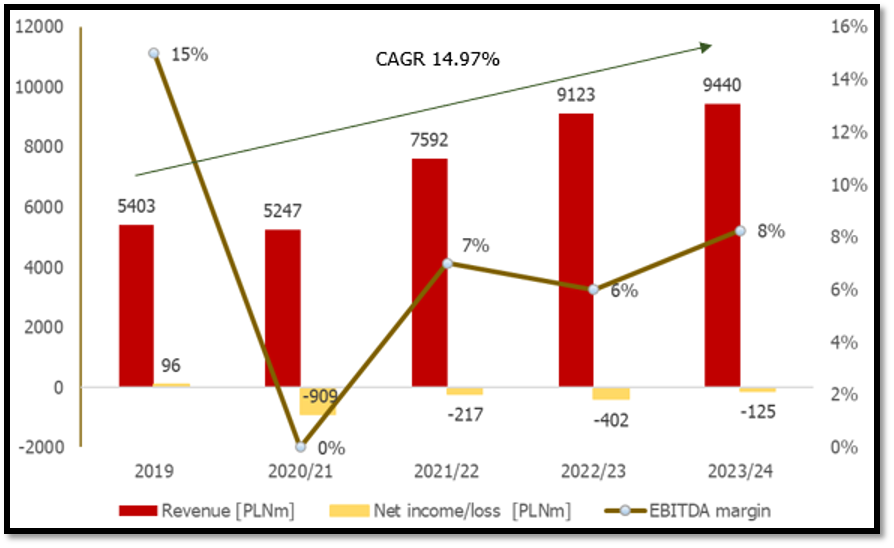

Before the pandemic, the company experienced dynamic growth with a revenue CAGR of 21.9% (2004-2019 period). However, due to the global consumption slowdown and inflation, revenue growth slowed significantly (CAGR 15% for 2019-2023/24) in the last years. In 2023/24, CCC generated revenues of PLN 9.4bn (+3.5% y-o-y), EBITDA of PLN 778.4m (+46.6%, margin 8.2%, an improvement of 2.4% y-o-y), and a net loss of PLN -124.7m (2022/23: PLN -443.9m). The Group generated operating cash flow of PLN 820.9m (+51.8% y-o-y), free cash flow of PLN 495.8m (+479.2%), while net debt / EBITDA decreased to 2.35x (2022/23: 4x). CCC’s ROCE was 5.1% compared to Zalando’s 3.7%. Key factors contributing to improved profitability were the absence of foreign exchange losses (2022/23: PLN 60.7m), a lower number of write-offs on trade receivables (PLN -3.9m vs. PLN -44.7m in 2022/23), and financial income (PLN 124.1m vs. PLN 54m in 2022/23).

CCC S.A. Revenue, EBITDA margin and Net Income (2019-2023/24)*

*From 2020, the reporting period has started in February of the given year and has ended in January of the following year

Net income/loss including non-controlling interests

Source: CCC S.A., East Value Research GmbH

In 2023/24, CCC Group generated 54.4% (PLN 5.1bn) of its revenues in the Polish market. The largest foreign market was Romania (revenues of PLN 817.8m, +3.9% y-o-y, 8.7% of total revenues), while the fastest-growing one is Ukraine (PLN 187.9m, +587%). CCC had operated under a franchise model in Ukraine until 2023 but last year acquired a controlling stake (75.1%) in CCC Ukraine Sp. z o.o. and is now developing its own distribution chain. After stabilization in Ukraine, it is highly likely that CCC will achieve sales levels similar to those in Romania there. CCC is a recognizable brand within the CEE region, and recent results have demonstrated significant growth potential for CCC in the Ukraine.

In terms of dividends, before the pandemic CCC paid them for 11 consecutive years. The company’s current dividend policy foresees the payout of 33%-66% of consolidated net profit.

Summary & Conclusion

In our view, CCC is a strong brand with a long and successful history and potential for further growth in the e-commerce segment. Despite being heavily indebted due to the pandemic, the company has swiftly reduced its debt to reasonable levels. We anticipate a further improvement in the EBITDA margin and expect double-digit revenue growth in 2024/25E. Favorable conditions boosting consumption in Poland, such as a positive real change in wages, suggest potential for CCC to enhance its financial performance for 2024E and beyond.

By the end of 2024E, the company plans to spin off its subsidiary Modivo S.A. (MODIVO and eobuwie.pl), which are responsible for its e-commerce business and accounted for 41.7% of the group’s total sales in 2023/24. The aim is to position it as a strong competitor to Germany’s Zalando. Modivo S.A., in which CCC holds a controlling 74.6% stake, was recently valued at PLN 4.9bn, with CCC’s stake valued at PLN 3.67bn (= 60.6% of its current market capitalisation). The Japanese Tech giant Softbank owns PLN 739.3m of Modivo’s convertible bonds with a duration until April 2026E and the right to convert to shares at a valuation of PLN 6bn.

Investors have taken note of CCC’s positive traction, with the stock gaining 43.9% YTD. With a consensus EV/EBITDA 2024/25E of 7.8x respectively compared to a 3y average of 14.9x (Source: marketscreener.com), we believe that CCC represents an attractive opportunity for investors seeking exposure to consumer stocks in CEE. In the long run, the company should also become a reliable dividend payer.

Author: Mateusz Pudlo