Business Description

Founded in 1990, Comp is currently the No. 1 provider of fiscal devices and IT security solutions in Poland. The company, which generates c. 7% of its total revenues abroad, operates two business units:

1. Retail Segment

-> Production and distribution of proprietary cash registers (including online and virtual versions), payment terminals, and add-on services such as M/Platform (an online big data platform for smaller shops for managing promotions, e-payments and e-invoices in cooperation with Eurocash, a leading wholesaler/retailer in Poland). Approximately 900,000 (thereof: c. 550k online ones that can be equipped with add-on services) of the total 1.8m (c. 1.1m) cash registers in Poland were produced by Comp.

-> Contributed 35% of total revenues in 2023

-> EBITDA margin of 12.9% in 2023

2. IT Segment

-> Provides IT security software and equipment for large enterprises and public administration. Comp holds all necessary certifications to conduct business with the Polish Ministry of Defence and the Armed Forces, which are difficult to obtain. Over the last 30 years, the company has built strong relationships with both public and private clients, as well as with international IT security solution providers such as Cisco Systems, Check Point Software, HP, IBM, Juniper, McAfee, and Symantec.

-> Contributed 65.1% of total revenues in 2023

-> EBITDA margin of 13.9% in 2023

Historically, Comp has been heavily dependent on third-party providers of IT security software and equipment, as well as on investment cycles related to cash registers and budgets for IT security projects. However, in our view the company now already generates over PLN 40m in monthly recurring revenues from proprietary add-on services for cash registers and from its own products (e.g. encryptors, identification tools). We believe that these high-margin categories are growing at >25% year-over-year and are expected to help Comp 1) reduce the seasonality of its business, which has historically been skewed towards H2, and 2) increase its EBITDA margin to 15-20% in the near future.

Comp’s shareholder structure is stable and long-term oriented. Polish pension funds own over 43% of the shares, the US-based fund Perea Capital Partners owns 6.7%, and CEO Robert Tomaszewski holds 6.3%. Since 2021, Comp has distributed PLN >70m to shareholders through dividends and share buybacks.

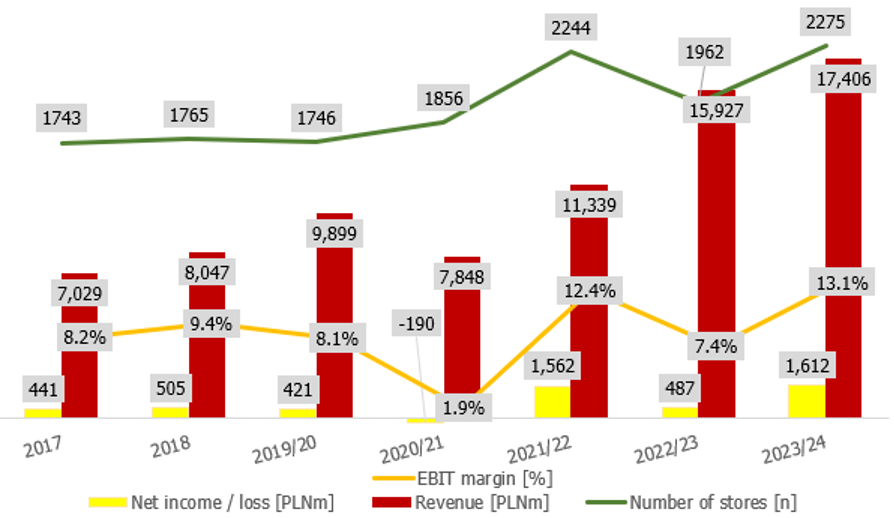

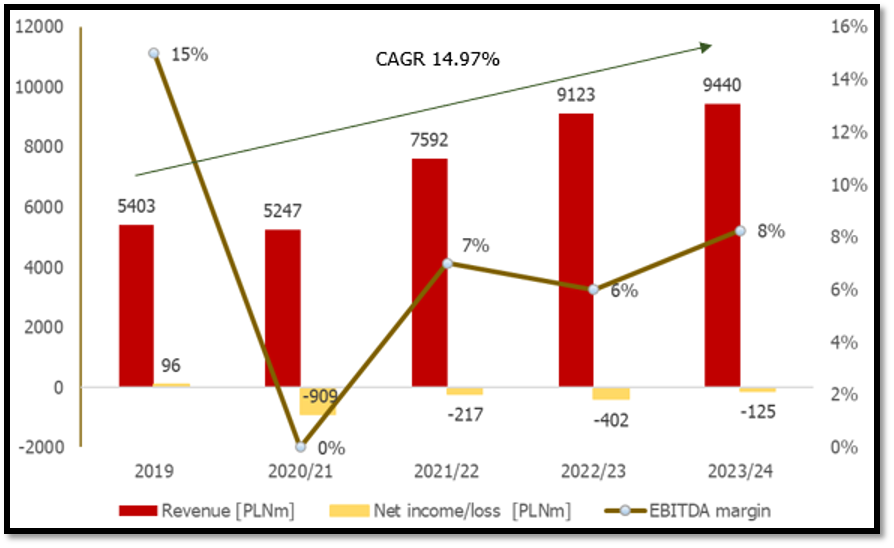

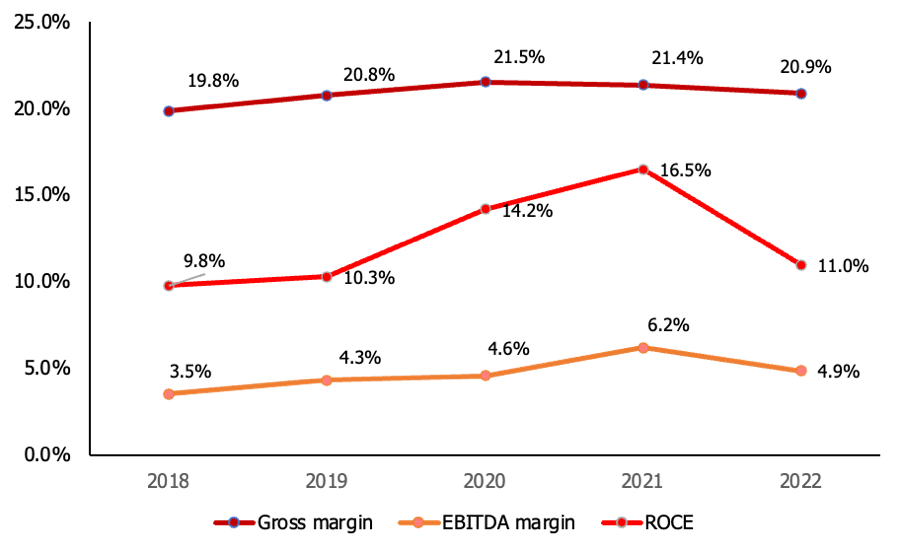

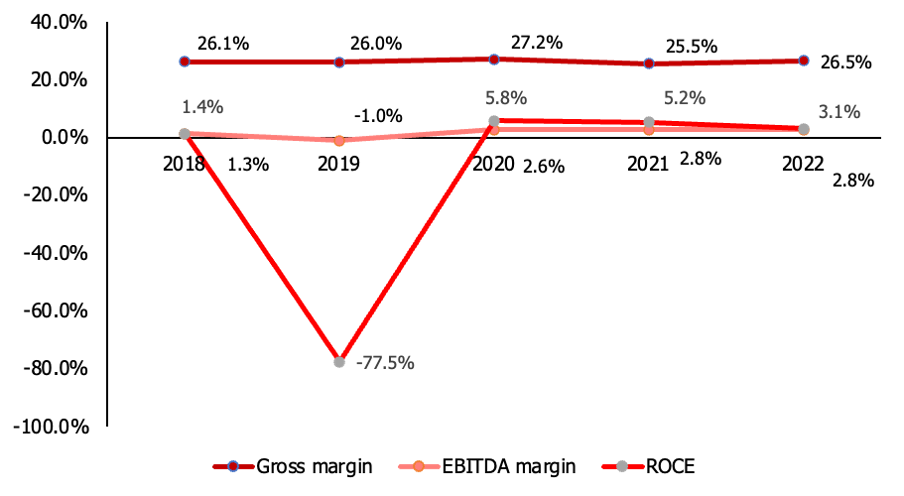

Latest Results

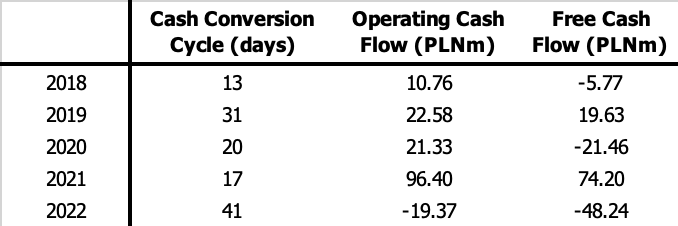

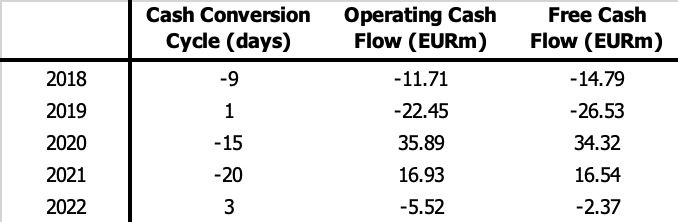

Over the past five years, Comp has increased its revenues and EBITDA at a CAGR of 8% and 9%, respectively. ROCE has historically ranged between 3% and 7%, but improved significantly to 9.9% in 2023, with further growth expected due to a focus on service revenues. For Q1/24, the company reported revenues of PLN 153.1 million (-28.8% y-o-y), including PLN 83.7m (-2.2%) from the Retail segment and PLN 69.6m (-46.4%) from the IT segment. In Q1/23, sales were positively impacted by several large but low-margin IT projects such as E-Health in the Pomorskie province and the Electronic Surveillance System. At the Group level, the EBITDA margin in Q1/24 increased to 18.4%, up from 11.6% in the previous year. In the Retail segment, the margin was 18.9% (Q1/23: 13.3%), and in IT, it equalled 24.9% (Q1/23: 14.3%). Between January and March 2024, Comp’s net income amounted to PLN 9.6m (+53.4%). The only negative was the decline in operating and free cash flow, which fell from PLN 38.2m in Q1/23 to PLN -86.1m, and from PLN 30.4m to PLN -94m, respectively. As of March 31, 2024, the company’s net debt stood at PLN 163m (net gearing of 36.6%), a reasonable level.

Summary & Conclusion

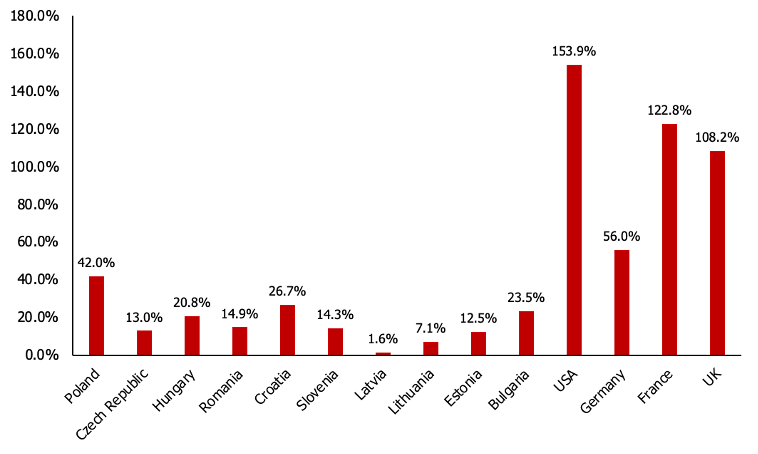

We appreciate that Comp is the market leader in its segments in Poland and that it has successfully introduced proprietary products and services with recurring revenues in recent years, which should positively impact operating profitability, cash flow generation, and ROCE going forward. It is also a positive sign that the company’s management team, holding over 6% of its shares, has been stable over time. Given its track record, Comp is well-positioned to benefit from the upcoming replacement cycle of older fiscal registers, potential extensions of the fiscalisation in Poland, increasing investments in IT security by large private enterprises (funded, for example, by the EU Reconstruction and Resilience Funds, which foresees EUR 4.6bn for digital transformation & cybersecurity until 2026E), and defense and security investments (with Poland’s defence budget at >4% of GDP).

Current sell-side forecasts for Comp project EBITDA of PLN 135m (+22.2% y-o-y) in 2024E and PLN 148m (+9.6% y-o-y) in 2025E, translating to an attractive EV/EBITDA multiple of 4.8x and 4.4x, respectively. Additionally, Comp plans to continue its distribution policy, with expected dividends and share buybacks for both 2024E and 2025E valued at PLN 8/share (yield of 7.9%).