Investment case

Zabka Group was founded in 1998 and is the largest chain of convenience stores in CEE (small local stores, often 24/7, where you can buy food, newspapers, send a package or withdraw cash) with currently 10,880 stores in Poland and 26 in Romania. The store locations, which are often in apartment buildings, are being selected by Zabka with an AI-based tool, which analyses millions of addresses and takes into account hundreds of KPIs.

The Zabka Group consists of two business units: Zabka Polska (focuses on operational and commercial aspects of the Group’s domestic business) and Zabka International (supervises the implementation of the foreign expansion strategy, especially in Romania, where Zabka cooperates with DRIM Daniel Distributie, one of the largest FMCG distributors there). The fully consolidated, 62%-owned subsidiary MasterlifeSolutions sp. z o.o. operates 1. Maczfit.pl – a diet catering that serves customers in Warsaw and almost 3,000 other locations in Poland with 418.8k monthly total visits according to Similarweb.com – and 2. Dietly.pl – a search and comparison engine for more than 300 diet catering and box diet companies in >1,000 Polish cities with 785.5k monthly total visits. The 100%-owned Lite ecommerce Sp. z.o.o is an Ecommerce startup that develops rapid grocery delivery services (Zabka Jush app, 100k-500k users according to sensortower.com) and e-commerce (delio app, 10k-50k users), including a dark stores network serving exclusively online orders.

Zabka, which currently has c. 2,000 employees & c. 9,000 franchisees, listed on the Warsaw Stock Exchange on October 17, 2024. During the IPO, which was valued at EUR 1.5bn/PLN 6.45bn and was the 4th largest in Polish history, the company’s owners, UK-based private equity fund CVC Capital Partners (76.89% stake before the IPO, now 40.82%), Australian Partners Group (18.02%, now 12.64%) and the European Bank for Reconstruction and Development, as well as members of the company’s board of directors sold in total 300m shares.

Zabka’s guidance for 2023-28E looks as follows:

1. 1,000+ new stores per year

2. c. 14,500 stores in Poland by 2028E

3. Mid-to-high single digit annualized LFL growth (7.5%-9% in 2024E)

4. 2x increase of the sales to end customers by 2028E vs. 2023

In terms of risks for Zabka’s business model, we believe that the main ones are 1. Changes in consumer trends 2. Increasing franchisee turnover (2023: 16%), and 3. Changes to the current Sunday trading bank law in Poland, which benefits Zabka.

Financial results

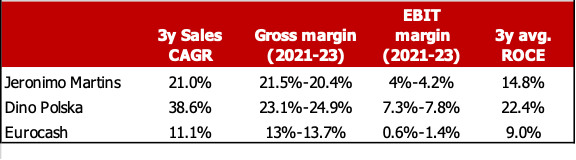

The available financial data for Zabka shows a significant double-digit growth on top-line and high profitability. In 2021-23, the company’s revenues grew at a CAGR of 25.9%, gross and EBIT margin reached 17.8-19% and 7-7.7% respectively and average ROCE equalled 12.4%. However, as the table below shows, this was weaker than the two largest players in the Polish food retail sector, Dino Polska S.A. and Portuguese Jeronimo Martins (Biedronka chain).

For 9M/24, Zabka reported revenues of PLN 17.7bn (+20% y-o-y), a gross margin of 17.9% (9M/23: 16.9%), EBIT of PLN 1.2bn (+28.7%, 7% margin) and a net income of PLN 377m (+154.7%). In January-September 2024, the company reached a LFL sales growth of 8.6% (Q3/24: +6%) and opened 892 new shops (366). While small format stores and hypermarkets lost market share in Poland, Zabka’s went up by 1.2% to 18.6%.

In 9M/24, Zabka reported an operating cash flow of PLN 3.4bn (+71.9% y-o-y) and a Free Cash Flow of PLN 1.4bn (9M/23: PLN 823m). At the end of September 2024, its interest-bearing debt equalled PLN 10.1bn (incl. PLN 4.7bn of leasing liabilities), thereof 11.3% was short term. However, negative was the fact that Zabka’s goodwill (PLN 3.4bn) was higher than ist equity (PLN 1.1bn).

Summary & conclusion

Although Zabka is a solid company with a strong brand, we believe that its current valuation, implying a P/E ratio of 33x-22x for 2024-25E (compared to a P/E ratio of 19.4x-17.1x for Jeronimo Martins and 26.8x-20.8x for Dino Polska, both of which generate a higher ROCE), can only be justified by the growth potential in the Romanian market (19.1m people, GDP growth >3% per year, real wage growth of approximately 7% year-on-year). While Poland remains attractive due to significant single-digit real wage growth and improving consumer sentiment, the growth potential for Zabka in its domestic market appears to be largely exhausted, with Zabka stores now located on nearly every corner.

Given the above, we advise investors to remain on the sidelines at the current price level. Another risk to consider is the likely further share sales by CVC Capital Partners and Partners Group in the coming quarters, which, in our view, will weigh on Zabka’s share price.

In our opinion, Zabka would be a BUY at a share price below PLN 16 (current price: PLN 20.91 per share).