Business description

Founded in 1998, Grupa Diagnostyka is the leading provider of diagnostic services in Poland, a country that still lags behind the OECD average in terms of health spending per inhabitant and its share in GDP.

Currently, Diagnostyka operates nationwide, with over 1,100 owned and more than 7,000 partner blood collection points, 156 diagnostic laboratories, and 19 diagnostic imaging centers. Each year, the company serves more than 20m customers and conducts over 140m exams. Its service offering includes laboratory exams such as analytical, microbiological (used to detect, identify, and study microorganisms), serological (used to detect and measure the presence of antibodies or antigens in a blood sample), histopathological (analysis of tissue samples), and genetic exams (DNA analysis); diagnostic imaging (ultrasound, computed tomography, magnetic resonance imaging, and remote analysis of diagnostic images for third-party clinics); as well as the collection, analysis, and transport of biological materials for B2B clients, including clinics, doctor’s offices, and research centers, both public and private.

In 2023, the B2C segment contributed approximately 40%, while the B2B segment accounted for around 60% of Diagnostyka’s total revenues, with a retention rate of over 95% in case of institutional clients.

Since 2011, Diagnostyka has grown both organically and through 128 acquisitions, including smaller independent laboratories and diagnostic imaging centers. In the near future, the company plans to focus its investments on further developing its proprietary software, particularly by adding AI functionality. Moreover, as the diagnostic imaging market in Poland remains highly fragmented, with the largest players controlling only around 55% of the market, management plans to focus its M&A activity on this area. The company expects to invest PLN 80m per year in the short term and PLN 70m per year in the medium term.

Financials

According to the company’s IPO prospectus, in 2011-2023 Grupa Diagnostyka has increased its revenues at a CAGR of c. 24% to PLN 1.6bn. In 2023, gross and EBITDA margin equalled 63.9% (2022: 63.8%) and 24% (25.7%) compared to 42.2% and 35.7% respectively at its main Polish peer Voxel, which offers diagnostic imaging services, produces radiopharmaceuticals and distributes software and equipment for radiologistics. Net income declined by 26.3% y-o-y to PLN 123.4m. Operating cash flow amounted to PLN 336m (2022: PLN 283.9m) and the free cash flow to PLN 164.5m (PLN 182.5m).

In 9M/24, Diagnostyka generated revenues of PLN 1.44bn (+22.5% y-o-y), a gross margin of 64.4% (9M/23: 64%), an EBITDA of PLN 378m (+30.3% y-o-y, 26.2% margin) and net income of PLN 169.6m (+80.3%). While the volume of exams increased by 13.3% y-o-y, the average price improved by 8.5%. At the end of September 2024, the company’s net gearing equalled 209.3% and thus was high. However, of the total interest-bearing debt of PLN 869.7m only 14.8% was short-term. Moreover, the net debt-to-EBITDA ratio equalled only 1.8x and in 2021-2023 never surpassed 2x.

IPO & shareholder structure

Diagnostyka, which is owned by the CEE-focused private equity fund Mid Europa Partners, announced its IPO on January 13. As part of the transaction, Mid Europa that invested in the company in 2011 is offering 16,147,124 of its shares at the maximum price of PLN 105 per share (IPO value: PLN 1.7bn, implied equity value of 100% of Diagnostyka: PLN 3.5bn). According to Polish media, the order book in the retail tranche was already filled after 1 hour, indicating a strong performance of the stock on the first trading day on February 7th.

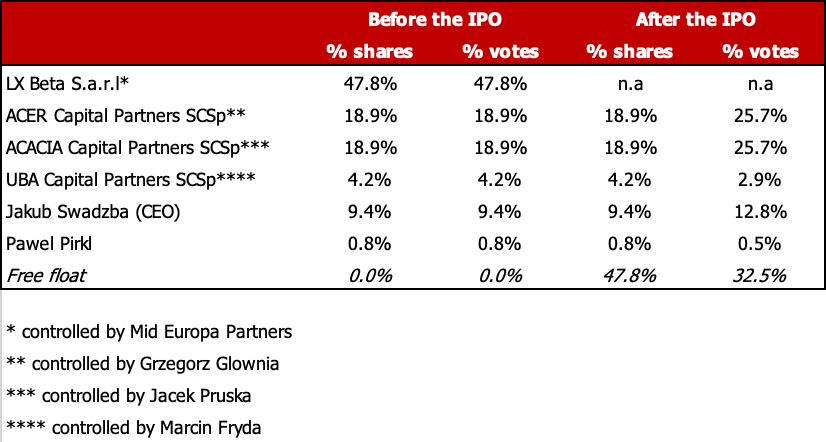

Below is an overview over Diagnostyka’s shareholder structure before and after the Initial Public Offering (Source: Diagnostyka’s IPO prospectus). After the IPO, the CEO Jakub Swadzba and other founders will collectively own 47.2% of the company’s shares and 64.1% of its votes.

Summary & conclusion

We believe that Diagnostyka is a company with an excellent track record and growth prospects. According to the OECD, in 2023 Poland only spent USD 2,682.10 per inhabitant on public & private healthcare, which is significantly less than e.g. Germany (USD 5,971.30) or even the Czech Republic (USD 3,227.80). By 2027E, the government plans to increase the share of public health spending in GDP from 6.2% in 2024 to 7% (Source: money.pl). For private health spending, which include e.g. out-of-pocket spending on health, latest forecasts foresee a CAGR 2023-2028E of 10% for the respective value to PLN 54bn (Source: PwC). While in the area of laboratory diagnostics, the market in Poland was valued at EUR 1.6bn in 2023 and its CAGR by 2030E is estimated at 7-9% (Source: Business Insider), the Polish diagnostic imaging market is expected to grow at 7% on average by 2030E from a value of EUR 1.6bn in 2023 (Source: Diagnostyka).

In our view at the max. price of PLN 105 Diagnostyka’s valuation is compelling compared to its main Polish peer Voxel. With 33,756,500 shares outstanding, net debt of PLN 834.3m and trailing EBITDA after 9M/24 of PLN 378m, Diagnostyka would be valued at a trail. EV/EBITDA of 11.6x compared to 12.5x for Voxel, whose current market capitalisation equals PLN 1.5bn.

Based on our analysis, we recommend investors to BUY Diagnostyka S.A.’s shares, which in our opinion represent an attractive long term investment opportunity. We would also like to emphasize that the company’s dividend policy includes a payout ratio of at least 50% of annual net profit going forward.