Emerging Europe is not just Poland: An overview over other stock exchanges in the region

With currently 777 listed companies (main regulated market + the alternative NewConnect segment), a combined market capitalization of PLN 1.3tr/EUR 285.9bn and a daily turnover of PLN 1.1bn/EUR 249.1m, the Warsaw Stock Exchange is by far the largest and most liquid stock exchange in Emerging Europe.

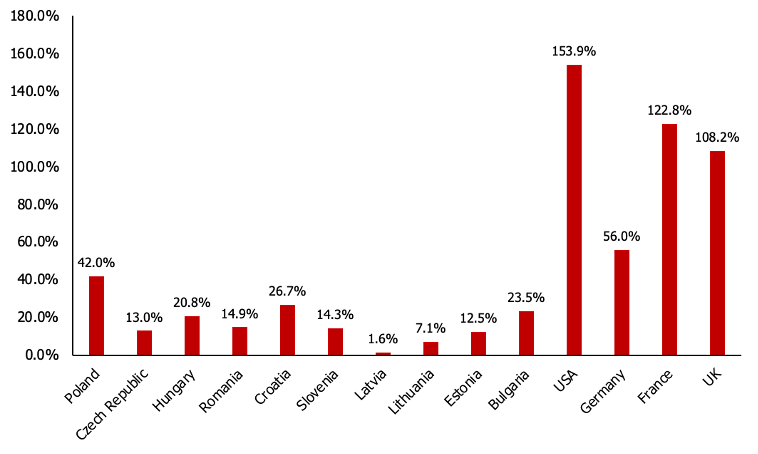

Given the economic catchup potential of the region, other capital markets are also worth a look, however they are usually characterized by very low trading volumes. In general, the value of listed stocks in Central and Eastern Europe (CEE) & South-Eastern Europe (SEE) is much smaller in terms of the market capitalization-to-GDP ratio than of Western markets.

Sources: World Bank, CEIC, GuruFocus, East Value Research GmbH

Czech Republic

In Prague, the combined market capitalization of local stocks equals c. EUR 55.7bn and the daily turnover amounts to c. EUR 93m. The largest companies are the utility CEZ, the tobacco producer Philip Morris CR and the banks Moneta Money Bank and Komercni Banka. All these stocks can also be traded via dual listing in Frankfurt. There is also the alternative START segment for small- and medium-sized Czech companies.

Hungary

In Hungary, the stock exchange has 69 companies, a combined market cap of c. EUR 35bn and a daily turnover of c. EUR 22.6m. The largest companies are from traditional sectors: OTP (the largest Hungarian bank), MOL (Oil & Gas), Gedeon Richter (one of the largest generic producers in CEE), Magyar Telecom (the largest Hungarian Telco). All of them also have a dual listing in Frankfurt. In 2017, the Hungarian stock exchanged launched a dedicated segment for small- and medium-sized companies, which is called Xtend.

Romania

With 19.1m inhabitants, Romania is the second most populous country in CEE & SEE after Poland. At 359 (84 in the main market and 275 in the alternative AeRO segment), its stock exchange has the second-highest number of listed companies in the region. Their combined market capitalization equals EUR 44.7bn. While liquidity is a major issue, investors can find very promising stocks, some of which with consistently high dividend yields. The largest of them are: OMV Petrom (an oil & gas company that is owned by Austrian OMV Group), SNGN Romgaz (a state-controlled gas company), SNN Nuclearelectrica (a state-controlled utility), Banca Transilvania (No 1 bank in Romania), and Fondul Proprietatea (an investment holding that invests in listed and privately held Romanian companies and is managed by Franklin Templeton. These companies can also be traded on foreign exchanges e.g. in London.

The Baltic countries

In the Baltic region, the companies are listed on the NASDAQ Baltic exchange, where there are currently 55 companies, thereof 24 from Lithuania, 11 from Latvia and 20 from Estonia. Their combined market capitalization equals EUR 10.4bn and daily turnover EUR 2.3m. The largest companies on the NASDAQ Baltics are Ignitis Group (a Lithuanian utility), Telia Lietuva (Telco), Enefit Green (an operator of renewable energy production units in the Baltics and Poland) and LHV Group (an Estonian bank).

The Balkan region

In the Balkan region, each country has its own stock exchange, but most are very illiquid. For example, in Belgrade the daily turnover of all listed stocks only equals c. EUR 44k. The largest stock exchange in the region is the one in Zagreb (market cap of all traded domestic stocks: EUR 19.6bn), followed by Ljubljana (combined market cap of EUR 8.9bn). In Zagreb and Ljubljana, the average daily turnover equals c. EUR 908k and EUR 1.1m respectively and the largest companies in terms of market capitalization are the oil & gas company INA, the leading bank in Croatia Zagrebacka Banka, the producer of generic drugs Krka and the Croatian Telco Hrvatski Telecom.