Progress in 2023 & results

2023 has been a very successful year for XTPL. The company signed various new distribution agreements (e.g. with Detekt Technology for Taiwan, with CWI Technical Sales & Ontos Equipment System INC for North America) and received new patents (e.g. in Malaysia, US, Germany, China, Vietnam). While the number of Delta Printing Systems sold was higher than we had expected (13 vs. 12), 5 thereof will only be included in the company’s results in 2024E. The number of sold printing heads was lower than we had forecast (3 vs. 5).

In 9M/23, XTPL’s revenues from sales of products and services reached PLN 9.2m, which corresponds to a y-o-y growth of 38.2%. Thereof, PLN 417k (+155.2% y-o-y) stemmed from sales of nano inks, PLN 2.7m (-41.1%) from R&D services and PLN 6.1m (+220.4% y-o-y) from sales of Delta Printing Systems. In 9M/23, EBITDA equalled PLN -1.2m (9M/22: PLN -1.3m) and net income PLN -2.6m (PLN -2.1m). Operating cash flow (PLN -3.1m vs. PLN 1.1m) was weaker than last year following a PLN 1.7m increase of working capital. Due to the capital increase in July, which had a volume of PLN 36.6m gross (275,000 shares at PLN 133), the company’s cash position reached PLN 31.7m. At the end of September, XTPL had interest-bearing debt of PLN 4.2m, of which PLN 3.9m was short-term (thereof, PLN 3.2m of bonds that will be converted into 45,655 shares at, we believe, PLN 74 per share, according to a public announcement from January 15th, 2024).

As of 30/09/2023, XTPL had 61 employees compared to 45 as of 31/12/2022. Thus, within 9 months the number of staff increased by >35%.

Our new forecasts for 2024E and beyond

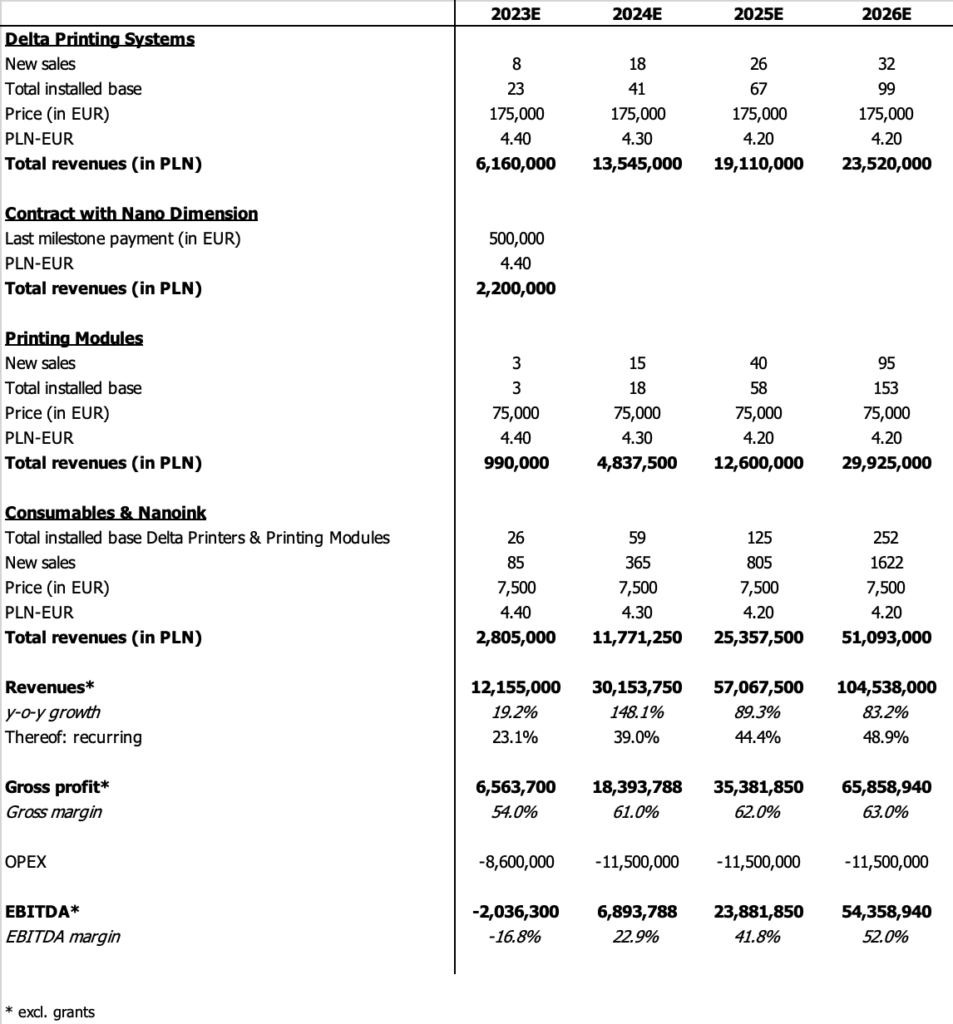

As in 9M/23 XTPL’s results were below our expectations and in H2/23 the company started the planned investments in sales and production capacity – according to its strategy, it wants to invest c. PLN 60m by 2026E among others in own sales offices/show rooms in Taiwan, South Korea and the US – we now believe that revenues in 2023 reached PLN 12.2m (prev. PLN 17.8m) and EBITDA PLN -2m (PLN -665k).

In our view, 2024E will be a breakthrough year for XTPL as we expect the start of the first full-scale commercial integration of its technology in H2/24E (currently, it has 9 industrial projects in the pipeline). This will allow the company to significantly increase recurring sales of its high-margin nano inks.

Conclusion

In conclusion, our optimism for XTPL remains steadfast. The company’s strategic approach is proving effective, evident from the consistent announcement of new sales contracts and distribution agreements at regular intervals. Anticipating a break-even on all levels by the end of the fiscal year 2024E, we do not foresee the need for another capital increase in the near future.

Notably, XTPL’s cutting-edge technology has undergone testing and validation by partners in Asia, including Nano Dimension from Israel and HB Technology from South Korea. Moreover, signs point to its adoption by prominent tech companies in the United States. A recent job posting by META seeking a Research Scientist Intern with experience in handling XTPL printing technology strongly suggests the integration of XTPL’s technology within this FAANG company (link: https://www.metacareers.com/jobs/880047783530931/).