Romania – Is it worth investing there, despite recent political and economic turmoil?

In 1990, Romania had a GDP per capita similar to Poland’s. Today, it is more than ten years behind its CEE peer in terms of development, which in our view mainly results from weak governance and populist fiscal policies. Nevertheless, we are convinced that the EU country – and especially its listed companies – offer long-term investors significant growth potential.

Political situation

2024-2025 were tumultuous years for Romanian politics after Calin Georgescu, a far-right, anti-establishment, and eurosceptic politician, won the presidential election in November 2024, triggering a stock market crash and sending bond yields through the roof.

Romanian 10y bond yield

Source: tradingeconomics.com

Romanian BET index has significantly recovered since mid-2025 to new ATHs

Source: stooq.pl

Due to accusations that the first round of the presidential election was manipulated by Russia, the vote was repeated in May 2025, and the EU-friendly, pro-Ukraine candidate Nicusor Dan won. Moreover, in June 2025, a new government coalition was formed, and since then Romania has been governed by the pro-EU PNL (National Liberal Party), PSD (Social Democratic Party), and USR (Save Romania Union).

Macroeconomic situation

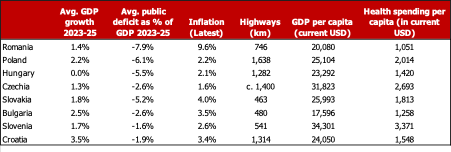

In recent years, especially since the 2020 pandemic, Romanian governments have spent significant amounts on social benefits, public sector wages, and energy subsidies. This has led to large public deficits and political instability, which in turn have delayed the implementation of necessary reforms and created considerable uncertainty among business owners and international investors. Over the past three years, Romania’s economy has been less dynamic than that of most other CEE countries — the average GDP growth rate in 2023–2025 was 1.4%, compared to e.g. 2.2% in Poland, 2.5% in Bulgaria and 3.5% in Croatia.

Major macro and development indicators of former ex communist EU members

Sources: tradingeconomics.com, World Bank, autostrady.com

The large budget deficit, which since 2020 has always been between 6.3% and 9.3% of GDP, the highest in the EU, forced the Romanian government to implement several countermeasures, which stabilised public finances but resulted in high inflation:

- Energy price liberalisation

- An increase of the VAT rate from 19% to 21% and the introduction of a single reduced VAT rate for e.g. food, books and drugs of 11%

- An increase of the tax on dividends and investment gains incl. crypto assets from 10% to 16%

- Increase of excise duties on alkohol, tobacco and energy by c. 10% and

- A higher additional turnover tax for credit institutions of 4%, up from previously 2%

Conclusion

We believe that despite current difficulties, Romania—which has been an EU member since 2007—has excellent long-term growth prospects. We see particularly strong catch-up potential in infrastructure, consumption, and health services. While Romania has only about 750 km of highways compared to about 1,600 km in Poland, its GDP per capita (in current USD) remains 53.5% below the EU average (USD 43,145), and health spending per capita is just USD 1,051 versus USD 5,005 on average in the EU. Apart from high-quality stocks such as MedLife (Market cap EUR 1.5bn), Aquila (EUR 422.7m), Fondul Proprietatea (EUR 390.3m) or Sphera Franchise Group (EUR 294.3m), a promising way to play the “Romanian investment story” could be investments in the operator of the stock exchange BVB (EUR 82.2m) and the largest local banks Banca Transilvania (EUR 7.8bn) and BRD (EUR 4.6bn). Most of the above-mentioned stocks can also be traded in Frankfurt.