Russia’s aggression on Ukraine, which started on February 24 this year, has lasted 10 months to date. The UN estimates the number of Ukrainian civilian casualties, which have so far been caused by the war, at >17,000 (>6,700 deaths, >10,400 injured), while according to the NYTimes the number of dead or wounded soldiers equals >100,000. The Kiev School of Economics believes that the losses due to destruction of infrastructure amount to USD >130bn. In November, Ukrainian President Wolodymir Zelensky confirmed that up to 40% of his country’s critical energy infrastructure had been destroyed.

From the beginning, Poland has been one of Ukraine’s largest supporters. According to Kiel Institute for the World Economy, only Latvia and Estonia have so far spent more on financial, humanitarian, and military aid as percentage of GDP than Poland. Moreover, since the outbreak of the war the country has provided refuge to >8.5m Ukrainians, who had fled their country after the outbreak of the war (Source: 300gospodarka.pl).

While the war continues, it is clear that the fighting will stop sooner or later. In this blog post, we analyse, which Polish companies could potentially benefit from contracts related to the re-building of Ukraine in the coming years.

Most obvious beneficiaries are construction companies

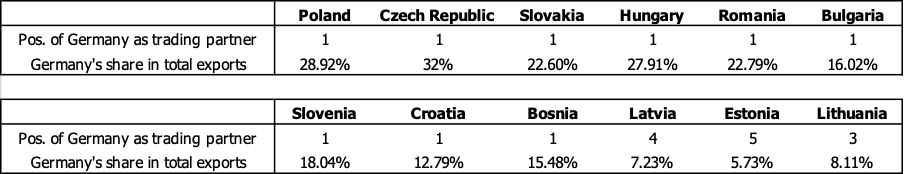

After a ceasefire agreement, the Ukraine will start re-building its infrastructure e.g. bridges, roads, energy infrastructure, buildings. In our view, it is likely that the public administration will mandate foreigners with a large part of this task. Apart from US-based companies – the US is by far the largest provider of military support to Ukraine – we expect that Polish firms will strongly benefit from Ukrainian orders.

Here are some examples of listed companies, whose results could be positively affected in the coming years:

1. Budimex S.A. (Market cap EUR 1.5bn): Owned by Spanish construction giant Ferrovial, Budimex’s main activities consist of the construction of roads, bridges, and airports; the design, development, construction and maintenance of industrial plants and environmental facilities; the construction of public and commercial facilities, and development of residential property. In 2021, the company generated revenues of PLN 7.9bn (CAGR 2016-2021 = 7.3%) and an EBITDA margin of 9.3%. Last year, 4.6% of its total revenues stemmed from abroad. Budimex has paid a dividend in each of the last 14 years.

2. Erbud S.A. (Market cap EUR 89.7m): Erbud, whose largest shareholder is German family-owned construction company Wolff & Müller Holding GmbH & Co. KG, operates in the areas of building & residential construction, road construction, industrial construction as well as engineering & services for the Energy sector. In 2021, the company generated revenues of PLN 3.1bn (CAGR 2016-2021 = 11.6%) and an EBITDA margin of 4.3%. Last year, approx. 13.3% of its total sales stemmed from abroad, especially Germany, Belgium, Norway, France, Sweden and Austria. Between 2014 and 2018, Erbud paid a dividend every year.

3. Torpol S.A. (Market cap EUR 92.9m): Torpol focuses on construction services related to transport infrastructure e.g. railway and tramway tracks and stations, as well as engineering services. It also provides services in the field of construction, modernization, and renovation of medium- and low-voltage overhead electricity networks, traffic control light signals, street lighting systems and telecommunications networks, as well as design services. In 2021, Torpol generated revenues of PLN 1.1bn (CAGR 2016-2021 = 7.8%) and an EBITDA margin of 11.4%. Only a very small share of revenues stemmed from abroad. Between 2014 and 2021, Torpol did not pay a dividend only once: for 2017.

4. Unibep S.A. (Market cap EUR 60.4m): Unibep operates in Poland (80.6% of total sales in 2021), Norway (10.9%), Germany (2.7%), Sweden (1%), Belarus (0.2%) and in the Ukraine (4.7%). The company builds roads and apartments and provides services related to construction and repair of bridges. Unibep, whose largest shareholders are Members of the Supervisory Board or their family, generated total revenues of PLN 1.7bn (CAGR 2016-2021 = 6.5%) and an EBITDA margin of 4.9% in 2021. The company has paid dividends for every year since 2008.

IT companies could also benefit

Due to the need to re-build the IT infrastructure of both the private and the public sector after the war we believe that the following Polish IT companies could receive significant orders from Ukraine in the coming years:

1. Asseco Poland S.A. (Market cap EUR 1.3bn): Asseco Poland is the 6th largest IT company in Europe and the largest in Poland. Approx. 78% of its revenues stem from own software and c. 90% from abroad. While no detailed sales figures are available, the company also does business in the CIS region.

Asseco Poland is market leader in the areas of public sector software in Poland, Czechia, Slovakia, and Israel. Moreover, it is a leading provider of software products for the sectors Healthcare, Energy, Telco, SMEs and Financials. The company has NATO certificates and provides cybersecurity solutions, which contribute PLN 200-300m to its total yearly sales. In 2021, Asseco Poland generated revenues of PLN 14.5bn (CAGR 2016-2021 = 12.8%) and an EBITDA margin of 15.5%. Since 2007, the company has always paid dividends.

2. Comarch S.A. (Market cap EUR 303.2m): Comarch is the No 2 Polish IT company with a share of c. 58% of international sales (of which c. 1.5% stemmed from Russia & Ukraine in 2021) and c. 16% of own products. The company provides its services to clients from various industry sectors (e.g. TMT, Finance/Banking, Retail, SMEs) and public administration. In 2021, Comarch generated revenues of PLN 1.6bn (CAGR 2016-2021 = 7.9%) and an EBITDA margin of 17.2%. The company has always been paying dividends since 2017. However, investors should be aware of corporate governance issues.