History & current business

Toya, which is based in Wroclaw/Poland, has been present on the market since 1990, when its predecessor Toya Import-Eksport S.C. was founded. In 2001, Toya was transformed into a joint-stock company and opened a distribution & logistics center in Wroclaw (Southern Poland). In 2003, it introduced the own brands YATO (hand & pneumatic construction, workshop and garden tools), STHOR (electrotools for construction and renovation work), VOREL (hand and pneumatic tools designed for electricians, locksmiths, service technicians, welders, plumbers and DIY enthusiasts), POWER UP/FALA/FLO (tools and devices for various applications) and started its international expansion: first to Romania – where today it has an office and warehouse with c. 7,000 sqm – and in 2008 to China (currently 29,250 sqm in the Zhejiang province). In Poland, Toya opened another warehouse in 2007 in Nadarzyn (24 km from Warsaw), which today has 26,370 sqm. Since its IPO in 2011, the company, which sells to >100 countries worldwide, has increased its revenues and EBIT at a CAGR of 11% to PLN 821m in 2024 and 7.2% to PLN 87.4m respectively. In 2024, 43.7% of its revenues stemmed from the Wholesale channel (sales from Poland, Romania and China), 11.8% from Retail chains (Poland & Romania) and 10.4% from Online (the company’s own web shops www.toya24.pl & www.toya24.ro as well as external popular online platforms, generates the highest gross margin of c. 46%). Last year, Toya’s international business accounted for 34.1% of its total revenues.

Einhell, which is based in Landau an der Isar/Germany, was founded in 1964. In 1968, it started its international expansion in Europe and Asia and in 1998 listed its shares on the Frankfurt stock exchange. Today, it has production facilities and warehouses in Germany (distribution, R&D, design and logistics center with a max. capacity of 2.3m products), in South-Western Hungary (production of battery packs and chargers incl. the Power X-Change battery platform mainly for European clients) and China (production of electro- and garden tools through external partners for international customers). Over the last 10 years, Einhell has increased its revenues at a CAGR of 10.3% to EUR 1.1bn in 2024 and its EBIT at a CAGR of 28.3% to EUR 101.2m. Last year, 61% of the company’s revenues stemmed from clients that are based in Western Europe incl. DACH, 12% from Eastern Europe and 27% from other parts of the world. While Einhell does not publish a detailed split of the share of distribution channels, it has made public in the past that most of its revenues are generated in stores for DIY enthusiasts and professional users. Proprietary products that are based on the Power X-Change platform account for >50% of Einhell’s annual revenues.

Profitability and Cash Flow

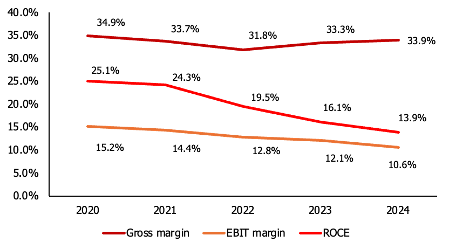

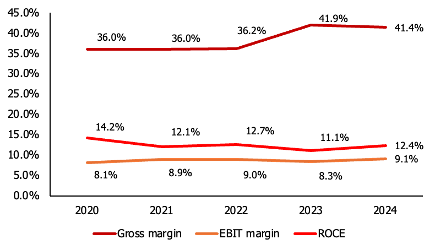

Over the past five years, both Toya and Einhell have consistently generated gross margins above 30% and delivered double-digit ROCE. While Einhell’s slightly higher gross margins suggest a more favorable product mix, including a greater share of own brands, its Polish peer has reported consistently higher EBIT margins—likely due to its main operations being located in countries with significantly lower wage costs than Germany.

Toya vs. Einhell: Gross margin, EBIT margin and ROCE 2020-2024

Sources: Company information, East Value Research GmbH

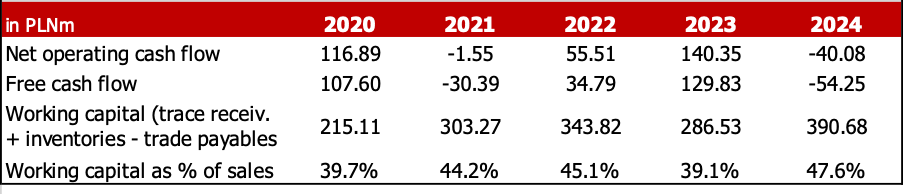

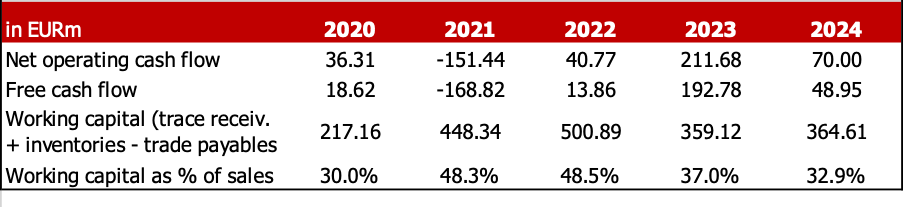

As the tables below show, in 2020-2024 Einhell has shown a stronger cash flow generation than Toya. In addition, due to a lower share of working capital in total sales it seems to better manage its working capital than its Polish peer.

Toya: Cash flow and working capital 2020-2024

Sources: Company information, East Value Research GmbH

Einhell: Cash flow and working capital 2020-2024

Sources: Company information, East Value Research GmbH

At the end of Q1/25 – the latest quarterly numbers that are available for both companies – Toya had a net gearing of 4.1% and Einhell 22.3%. 72.1% of the Polish company’s interest-bearing debt of PLN 61.5m was short term. In case of Einhell, its interest-bearing debt equalled EUR 134.3m (thereof 21% short-term).

Current valuation & conclusion

So far in 2025, Toya and Einhell generated a YTD return of 39.1% and 13.3% respectively.

Currently, the Polish company is valued at a P/E 2025E of 9.2x, which corresponds to a PEG ratio of 0.77 based on analyst’ consensus estimates. Its German counterpart is valued at a P/E 2025E of 11.3x (PEG = 0.92), which seems to be justified by its superior gross margins and cash flow generation. However, in terms of the PEG ratio the Polish company appears to be more attractively valued at present. An additional factor, which supports our bull case for Toya, is the announced share buyback of max. 12.5m shares at PLN 6-18 per share by 31/12/2027 (16.7% of total shares outstanding).

We expect that in the coming years, both companies will benefit particularly from the Do-It-Yourself (DIY) trend — driven by a growing number of people who believe they can complete home improvement projects more cheaply, more personally, and more sustainably themselves than by hiring contractors — as well as from a recovering construction sector, supported by declining interest rates.