This blog post is the latest chapter in our ongoing series analyzing Polish companies alongside their listed German counterparts. Today, we take a closer look at two leading e-commerce players specializing in the distribution of bicycles and related accessories.

History & current business

Dadelo was established in 2016 and became part of the Oponeo.pl S.A. Group in 2017, before being spun off and listed on the Warsaw Stock Exchange in 2020. The company remains closely linked to its parent, sharing key management — including Oponeo co-founder Ryszard Zawieruszy?ski — and is headquartered in Bydgoszcz, Poland. Since its public debut, Dadelo has grown to become one of the leading online retailers in the Polish bicycle market. With 17,500 m² of warehouse space, the company offers 85,000 selected products across 520 brands and employs over 200 people. Dadelo conducts its e-commerce operations through its own website, CentrumRowerowe.pl, and maintains four physical stores in major Polish cities. Currently, the company operates exclusively within its domestic market.

Dadelo’s growth strategy includes opening new physical stores in all Polish cities with populations over 200,000, aiming to create a nationwide network where the distance between any two stores does not exceed 200 km. According to the CEO, this expansion is expected to be completed within three years. While brick-and-mortar stores currently account for only a small share of total revenue — and at lower margins — they are the main sales channel for bicycles, which now represent nearly 50% of total revenue. For many customers, purchasing a bicycle is a significant investment, and the ability to see and test-ride the product in person remains a key factor in the buying decision.

Bike24 was founded in 2002 in Dresden, Germany, by Andrés Martin-Birner, Falk Herrmann, and Lars Witt. The company has grown into one of continental Europe’s leading e-commerce platforms for bicycles, with a strong presence in the DACH region (Germany, Austria, Switzerland). After a period under private equity ownership, Bike24 went public via an IPO on the Frankfurt Stock Exchange in 2021. In contrast to Dadelo’s focused domestic approach, Bike24 has pursued broad international expansion and now serves customers in over 70 countries through its main platform and 10 localized websites in key markets such as Spain, France, and Italy. The company employs over 500 people.

To support its extensive operations, Bike24 operates a primary logistics centre near Dresden and a second logistics hub in Barcelona, Spain (10,000 m²), aimed at improving service in Southern European markets. Its product offering includes over 70,000 carefully selected items from more than 800 brands.

The strategy of the German counterpart focuses on expanding into continental European markets through organic growth, although management does not rule out opportunistic acquisitions. This approach emphasizes localization by providing websites in national languages, integrating local and customary payment systems, and offering region-specific customer service.

In contrast to Dadelo, Bike24 operates without a physical retail network—aside from a single store in Dresden and a service point in Berlin — and is fully focused on e-commerce. Bike24 formally entered into direct competition with Dadelo’s online business in 2025 when it launched its Polish website. However, the platform currently accepts only euro payments and does not support BLIK, Poland’s most popular online payment method — factors that may discourage local consumers and limit market adoption.

Historical & current financials

Dadelo has demonstrated an impressive growth trajectory, increasing its revenues from PLN 64.5m in 2020 to PLN 280.5m in 2024, representing a CAGR of 44.4%. This growth has been driven by strong sales of both traditional and electric bikes, with the company offering popular third-party brands alongside its own in-house brands (Oxfeld and Unity), through both online and offline channels.

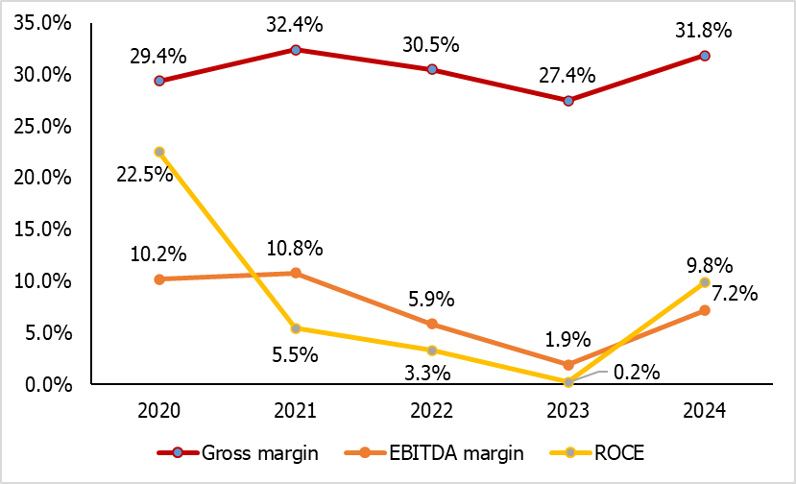

The share of bicycle sales has grown significantly — from 23.1% of total revenue in 2020 to 41.3% in 2024. Physical stores now account for 20–25% of total revenues, while e-commerce contributes the remaining 75–80%. Since its public listing, Dadelo’s EBITDA margin has ranged between 1.9% and 10.8%, while Return on Capital Employed (ROCE) has fluctuated between 0.2% and 22.5%. In 2024, the company fulfilled 648,200 orders, resulting in an estimated average order value of PLN 433 (approximately EUR 101.80).

Dadelo S.A.: Gross & EBITDA margins and ROCE in 2020-2024

Source: East Value Research GmbH, Dadelo S.A.

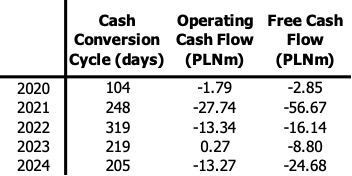

Dadelo S.A.: Cash Conversion Cycle, Operating and Free Cash Flow in 2020-2024

Source: East Value Research GmbH, Dadelo S.A., MarketScreener (for Cash Conversion Cycle)

During the same period, Bike24’s revenue CAGR was just 3.2%. Sales in 2024 reached EUR 226.3m, remaining nearly unchanged compared to 2023. Similar to the Polish company, the share of bicycle sales increased but still represents a relatively small portion of total revenue—rising from 9.3% in 2020 to 19.2% in 2024.

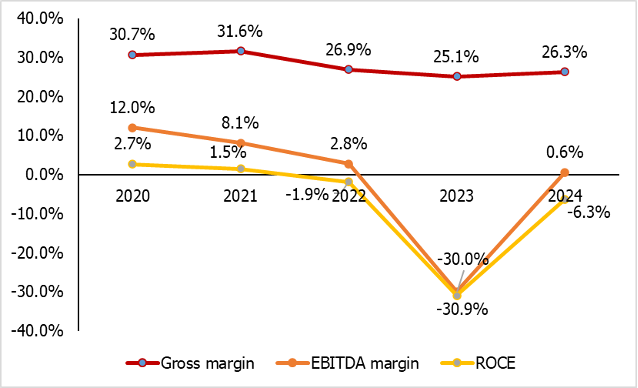

High inflation in 2022 and 2023 significantly weakened consumer purchasing power, leading to a downturn in both the bicycle market and the broader e-commerce sector in Germany. As a result, the company faced overcapacity issues, which contributed to higher-than-expected inventory write-downs. During the review period, Bike24’s EBITDA margin declined from 12% in 2020 to -30% in 2023, before rebounding in 2024. The sharp drop in profitability in 2023 was largely due to a goodwill impairment of EUR 56.7m. ROCE has remained negative since 2022.

In 2024, the company had 916,900 active customers who placed 1.567m orders (a 4% y-o-y decline), with an average order value of EUR 144 (up 5% y-o-y).

Bike24 Holding AG: Gross & EBITDA margins and ROCE in 2020-2024

Source: East Value Research GmbH, Bike24 Holding AG

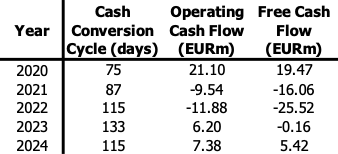

Bike24 Holding AG: Cash Conversion Cycle, Operating and Free Cash Flow in 2020-2024

Source: East Value Research GmbH, Bike24 Holding AG, MarketScreener (for Cash Conversion Cycle)

Over the past three years, Dadelo’s average inventory turnover ratio was 1.38x, compared to 2.49x for Bike24. As a result, Dadelo’s cash conversion cycle is approximately twice as long. While the Polish company’s inventory levels appear reasonable given rising costs and strong growth prospects, maintaining higher inventory levels also increases the risk of obsolescence and potential write-downs— particularly if the market experiences a downturn.

In contrast, its German counterpart maintained relatively lower inventory levels, reducing them by EUR 10.3m in 2024, which contributed to a positive operating cash flow of EUR 7.4m. Despite reporting net income of PLN 11.5m in 2024, Dadelo posted negative operating cash flow of PLN -13.3m, primarily due to a PLN 70m increase in inventories.

As for financial projections, Dadelo’s CEO recently stated in an interview that the company expects to exceed PLN 400m in revenue in 2025E and aims to sustain a robust annual growth rate of 30% over the next five years. Dadelo’s strategic goal is to capture 35–40% of the Polish bicycle and accessories market, which is estimated to be worth PLN 4.5–5bn.

Meanwhile, Bike24 — supported by strong H1 2025 sales — is forecasting up to 15.3% y-o-y revenue growth for 2025E.

Current valuation & conclusion

Both stocks have experienced a remarkable run in 2025, with Dadelo up 162.5% YTD and Bike24 up 168.5% YTD. As a result, both companies are currently trading above their 3-year average EV/Sales multiples.

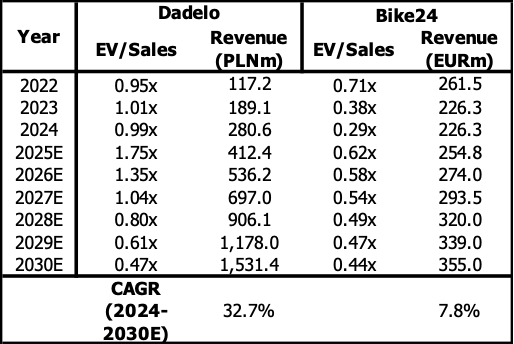

In the table below, we present market estimates of EV/Sales for Bike24, alongside our own calculated EV/Sales for Dadelo. Our calculation is based on the CEO’s projection of 30% annual growth over the next five years, which would result in estimated revenues of PLN 1.5bn by 2030E.

Source: East Value Research GmbH (Dadelo 2025E-2030E estimates), CapitalIQ, MarketScreener

While Dadelo’s valuation may appear high compared to its peer Bike24, it is justified by our estimated CAGR of 32.7% for 2024–2030E, versus 7.8% for Bike24. This level of growth, while ambitious, is still below Dadelo’s historical CAGR for 2020–2024. Moreover, we believe the estimates are attainable, given Dadelo’s superior business model and strong management track record.

If Dadelo successfully achieves its domestic targets, the company views expansion into comparable foreign markets—such as the Czech Republic or Hungary—as feasible within a few years. Considering that bike sales are strongly supported by physical retail locations, and with multiple new stores planned over the next three years, along with potential international expansion, we believe the stock could reasonably trade at 2.0x EV/Sales for 2025E. This would imply a share price of over PLN 60.

In the case of Bike24, its lower valuation metrics reflect the company’s underwhelming performance, with revenues showing minimal growth since 2020. Despite a strong share price rally in 2025, the stock continues to trade well below its IPO price from 2021. Additionally, Bike24 still generates a significant portion of its revenue from bike parts, accessories, and clothing—a segment facing intense competition as consumers increasingly turn to lower-cost alternatives, particularly from China.

With both companies reporting strong results for H1 2025, we expect this positive momentum to continue throughout the remainder of the year. However, in the long term, bicycle sales growth rates in both countries are projected to decline. The German market is showing signs of saturation, while in Poland, growth is slowing as pandemic-era demand normalizes.

In an industry where both companies operate, sustaining growth will depend not only on operational excellence and capitalizing on transformative trends — such as the rise of e-bikes — but also on strengthening customer retention in an increasingly competitive market.

Author: Mateusz Pudlo