Analysis: LPP S.A. (Market Cap: PLN 31.3bn/ EUR 7.3bn) – largest clothing retailer in Central and Eastern Europe

Business description

LPP, founded in 1991 by Messrs Jerzy Lubianiec and Marek Piechocki, has become a leading player in the Central and Eastern European clothing market. Currently, LPP operates in 39 countries across three continents, with over 2,000 stores and approximately 33,000 employees. The company is the ninth largest in Poland by market capitalisation. LPP made its debut on the Warsaw Stock Exchange in 2001 and is currently included in the WIG20 and MSCI Poland indices. LPP’s majority shareholder is the Semper Simul Foundation, established by one of the company’s founders.

The Group’s sales are primarily derived from five fashion brands: Reserved, Cropp, House, Mohito and Sinsay. The company has no production facilities of its own and sources over 90% of its goods from Asia. Clothing is designed in Spain and Poland, with distribution centres in Poland, Slovakia and Romania. Management is looking to expand further, with plans to increase retail space by 25% in 2024E and c. 20% per annum in 2025E and 2026E. CAPEX for 2024E is forecast at PLN 1.5bn, of which PLN 1.2bn is for new stores as LPP plans to open over 700 new shops.

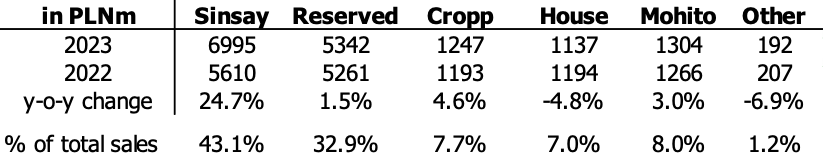

Revenues of business lines of LPP for 2023 and 2022

Source: LPP S.A., East Value Research GmbH

Over the years, LPP’s affordable prices and new designs have earned the Group a loyal customer base. Sales are primarily generated through offline stores, with e-commerce accounting for only 24.6% of total sales (-3% y-o-y pp). Despite being the youngest brand in the group, Sinsay generated more than 43.1% of total sales in 2023. Furthermore, Sinsay is the group’s fastest-growing brand, having tripled its number of offline stores in just four years. This promising brand not only offers clothing but also home accessories, competing with Pepco, KiK or Primark in the offline segment, and is also a leading player in e-commerce, where it competes with Chinese online shops Shein and Temu.

Hindenburg Research Report on LPP

In 2022, following the invasion of Ukraine by Russia, LPP’s management decided to sell its Russian business to a Chinese consortium and Anna Pilyugina (former CEO of LPP Russia). The purchase agreement foresees the payment for stores and inventories in instalments, with the final payment scheduled for 2026E. The company opted for the least costly option for exiting the Russian market, which benefits LPP investors. Nevertheless, from a long-term perspective, it was a misguided decision to continue expanding into the Russian market and increasing inventory for this market.

In March 2024, Hindenburg Research wrote a lengthy report on LPP’s exit from the Russian market. The report had a significant negative impact on the company’s share price, which fell by approximately 35% shortly after publication. The report’s title, “A Fake Russia ‘Sell-Off'”, suggests that LPP is willing to return to the Russian market after the war. The primary concern is the option for LPP to buy back the Russian part of the business. However, in the lengthy report, this option is mentioned in just one sentence. In an attempt to justify its title statement, Hindenburg presents other arguments, such as a change of auditor and encrypted barcodes. However, LPP has debunked these arguments. After several weeks of clarification and the dismissal of the allegations by LPP, the share price has almost returned to its pre-scandal peak

In our view, LPP Group has successfully defended its position against the majority of Hindenburg Research’s arguments. Regarding the main concern, the option to buy back the business, LPP has stated that the option was requested by the buyer and that exercising the option is not feasible due to the need for approval from a Russian government body. Russia has designated Poland as a hostile nation and a significant portion of LPP’s shares are held by Polish investors.

We believe that the consequence of the Hindenburg Report will be a stronger focus of LPP on expansion in Western and South-Eastern Europe than previously predicted.

Financials

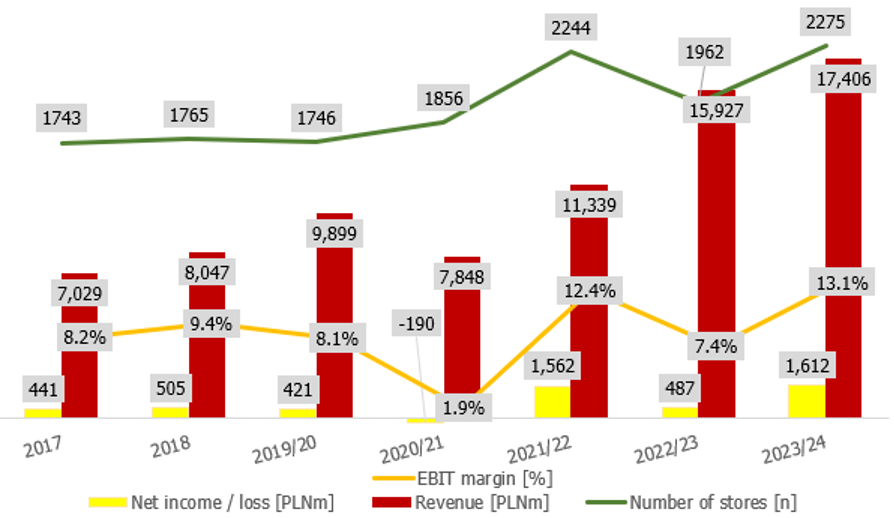

Over the past decade, LPP has experienced rapid growth, with a CAGR of 15.5% in sales and the addition of almost 1,000 stores. In 2023, the Polish clothing company generated revenues of PLN 17.4bn (+9.3% y-o-y), EBIT of PLN 2.28bn (+92.8%; margin 13.1%), and a net income of PLN 1.6bn (+232.3%; margin 9.3%). The sales performance has been enhanced by the Sinsay brand, which has reported a 24.7% y-o-y growth. The profitability improvement has been achieved through cost optimisation in the following areas: Slower increase in CoGS in the amount of PLN 8.4bn (+6.7% y-o-y), that mostly consists of valuation of inventories at purchase price from suppliers. Operating costs decreased by 2.1% y-o-y to 6.6bn, with advertisement costs PLN 432.5m (-44.5%) declining the most. Operating cash flow improved significantly from PLN 622m to PLN 4.34bn, free cash flow improved as well from PLN -534.6m to PLN 3.3bn, with net debt/EBITDA ratio dropping from 1.9x to 1.0x.

Geographically, LPP’s home market Poland accounted for 42.4% of total sales or PLN 7.38bn (+7.6% y-o-y). However, international markets have seen even faster growth (sales of PLN 10bn, or +10.5% y-o-y). The largest foreign market is Romania, with sales of PLN 1.45bn (+8.9% y-o-y; 8.3% sales share). Ukraine is the second largest foreign market, with sales of PLN 1.18bn (+70.7%; 6.8%). The fastest growing foreign markets that LPP recently entered are Greece (+462.5% y-o-y; sales) and Italy (+409.2%).

LPP S.A.: Revenue, EBIT margin, Net Income and Number of stores (2017-2023/24)*

The most recent results for Q1/2024 indicate that the company is set for a very successful year in 2024E. In Jan-Mar 2024, LPP generated revenues of PLN 4.3bn (+18.3% y-o-y), with the Sinsay brand showing the strongest growth (+54.1%). There has been a significant improvement in profitability, with an EBIT of PLN 411m (+78.2% y-o-y; margin 9.5%; +3.2% pp), resulting in a net income of PLN 277m (+147.8%; margin 6.4%; +3.4% pp). Western Europe has been the fastest growing region, with sales growth of 31% y-o-y (6% of total sales) and retail space growth of 59.7%.

Conclusion

We like LPP due to its successful track record spanning over 30 years and the fact that, thanks to its excellent logistics, it still has plenty of opportunities for international growth. For 2024E, the company predicts revenues amounting to PLN 21bn, and the current consensus EV/EBITDA 2024E is 7.9x. This valuation seems attractive both compared to its 3-year average (9.6x) and its peers (e.g., Abercrombie & Fitch Company -> EV/EBITDA 2024E of 9.4x, Inditex -> 12.6x, H&M -> 8.2x; Source: marketscreener.com).

In our opinion, LPP is a superb stock for investors looking for a company with characteristics of both growth and value stocks. LPP generously rewards its investors: the current dividend policy for 2023-2025E foresees the payment of a minimum of 50% of non-consolidated net profit.

The main risks we have identified are as follows:

1. Supply chain disruptions

2. New country performance risk

3. Changes in consumption trends